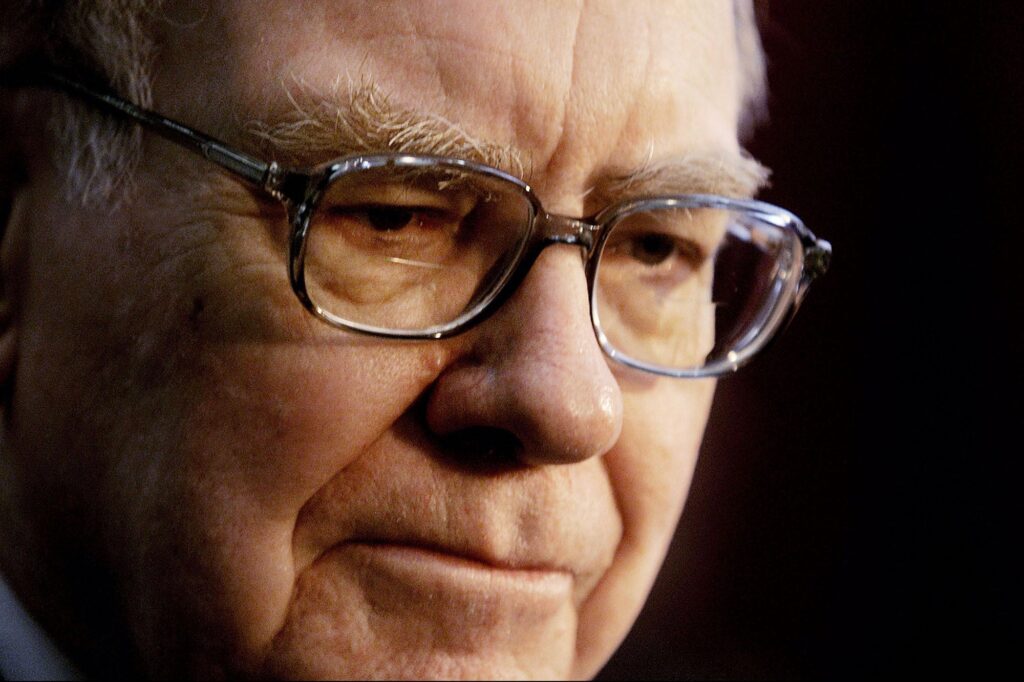

Warren Buffett, chairman and CEO of Omaha, Nebraska-based holding firm Berkshire Hathaway, is without doubt one of the world’s most well-known buyers, with a net worth north of $145 billion.

Picture Credit score: Eric Francis | Getty Pictures. Warren Buffett.

Nonetheless, like all profitable buyers, Buffett needed to begin someplace.

In his biography The Snowball: Warren Buffett and the Business of Life, writer Alice Schroeder recounts Buffett’s early fascination with cash — and an necessary lesson he realized from his first funding.

Buffett bought his first style of entrepreneurship at age six when he began promoting packs of chewing gum. “I’d purchase packs of gum from my grandfather and go round door to door within the neighborhood promoting these things,” Buffett tells Schroeder. “I used to do this within the night, largely.”

Ultimately, the younger entrepreneur moved on to promoting Coca-Cola, a extra worthwhile enterprise that earned him a nickel each six bottles. Promoting golf balls on the Elmwood Park golf course and peanuts and popcorn on the College of Omaha soccer video games adopted.

Sooner or later, Buffett visited the library and stumbled upon a guide known as One Thousand Methods to Make $1,000, which opened his eyes to the power of compound interest. Buffett needed to attempt it for himself.

Associated: Want to Become a Millionaire? Follow Warren Buffett’s 4 Rules.

By the next 12 months, 1942, 11-year-old Buffett had saved $120 to buy his first inventory: Cities Service Most popular. He took his sister Doris on as a associate and bought three shares for every of them for $114.75.

Sadly, the market hit a low that June, and Cities Service Most popular plummeted from $38.25 to $27 a share, a indisputable fact that Buffett’s sister “reminded” him of on daily basis, Schroeder writes. So, when the inventory had recovered sufficient to internet a small revenue — $5 a share — Buffett bought.

Then, Cities Service Most popular skyrocketed to $202 a share.

Associated: Warren Buffett Finally Reveals What Mystery Company Got a $6.7 Billion Investment from Berkshire Hathaway

Buffett tells Schroeder the expertise was one of the necessary of his life as a result of it taught him three classes about investing:

- Do not “overly fixate” on what you’ve got paid for a inventory.

- Do not rush to promote for a small revenue.

- Do not make investments another person’s cash until you realize you may succeed.

The lesson has served Buffett, now 94, nicely over time. In August, Berkshire Hathaway surpassed $1 trillion in market value for the primary time.