Opinions expressed by Entrepreneur contributors are their very own.

“Nothing is definite besides dying and taxes.”

This proverb, typically attributed to Benjamin Franklin, has stood the check of time. But when I may add yet one more piece to this pearl of knowledge, it might be this: “Nothing is definite besides dying and taxes, however dying does not change; taxes are at all times altering.”

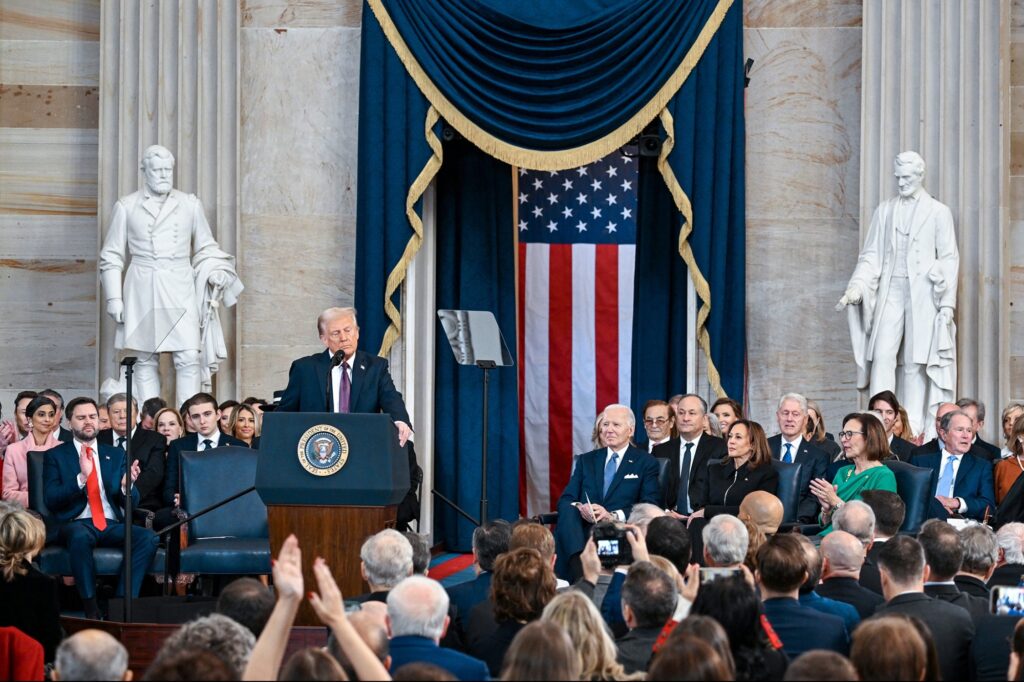

With President-elect Donald Trump’s second inauguration, entrepreneurs and traders are watching intently for these modifications. In his first time period, President Trump achieved probably the most vital overhauls to the tax code in many years with the 2017 Tax Cuts and Jobs Act (TCJA). With points surrounding the economic system and job development entrance and middle, the following 4 years could carry one other wave of change.

With lots of the tax cuts within the TCJA set to run out on the finish of 2025 absent Congressional motion, at the very least some change is inevitable. Nonetheless, how a lot change and what form is far more durable to foretell. The present political local weather means Republicans might want to drive any tax coverage modifications, however with a razor-thin majority within the Home, any single legislator can have large energy.

Regardless of the uncertainty, there are some issues entrepreneurs can seemingly anticipate.

1. The company tax fee is unlikely to extend

The TCJA slashed the company tax fee from 35% to 21% — a pro-business shift that has spurred investment in numerous industries. The excellent news for entrepreneurs is that this transformation is not amongst these set to run out.

President-elect Trump has publicly floated the concept of lowering the company tax fee even additional, potentially to 15% for corporations that make their merchandise within the U.S. Given considerations over the federal funds deficit, it is unclear when or if such a discount may come to cross. However the general message on company taxes is obvious: holding them low is a precedence.

2. Particular person tax charges will keep roughly the identical

Whereas the person revenue tax reductions and commonplace deduction within the TCJA are set to run out on the finish of 2025, extending them is broadly in style. In a 2023 survey by the Pew Analysis Middle, greater than half of U.S. adults stated they really feel they pay greater than their justifiable share of taxes and that the tax system is frustratingly complicated.

Given this public assist and President-elect Trump’s advocacy for extending the TCJA, we’re more than likely to see particular person tax brackets stay roughly the identical, and the usual deduction may even enhance.

3. Huge tax deductions are more likely to change

The TCJA launched or expanded a lot of tax deductions which are vastly precious to entrepreneurs. Listed below are three to look at:

- Certified Enterprise Revenue (QBI) deduction

This deduction permits many house owners of pass-through companies to deduct as much as 20 p.c of their certified enterprise revenue, plus 20 p.c of certified actual property funding belief dividends and certified publicly traded partnership revenue. The deduction is out there even for taxpayers who take the usual deduction, and it has been a game-changer for small enterprise house owners.

Sadly for a lot of entrepreneurs who depend on this deduction, its extension could not make the lower within the upcoming tax debate; many Democrats argue it’s serving to the rich on the expense of common taxpayers, and lots of Republicans will prioritize reductions to the company tax fee over the QBI.

Bonus depreciation is a tax deduction the federal government makes use of to encourage companies to put money into sure property, together with some gear, software program, autos and rental actual property. The TCJA increased bonus depreciation from 50% to 100% till 2022. Since then, it has dropped by 20 proportion factors every year and is about to achieve zero by 2027 with out Congressional motion. President-elect Trump has proposed reinstating a full 100% bonus depreciation deduction, and I anticipate the brand new Congress to assist this for manufacturing and different gear purchases. Nonetheless, actual property purchases appear much less sure.

- State and Native Tax (SALT) deduction

Entrepreneurs dwelling in high-tax states have felt the pain of the $10,000 cap the TCJA placed on deducting state and native taxes. Intense strain from lawmakers in sure states with high-income residents will seemingly result in a rise on this deduction. With out motion by Congress, the cap will expire on the finish of 2025. Nonetheless, given considerations over the funds deficit, it is extra seemingly that we’ll see lawmakers choose to extend the cap.

- Fewer, if any, inexperienced power incentives

In recent times, entrepreneurs and traders have made good use of a number of tax incentives that promote investments in electrical autos, solar energy techniques, wind farms and different renewable power and environmental efforts. The Inflation Discount Act of 2022, specifically, included significant tax credits for the price of renewable power techniques.

President-elect Trump advocated for a extra oil and pure gas-centric power coverage on the marketing campaign path, calling President Biden’s power coverage a “new green scam.” So, if the present incentives are a part of your tax technique, it’s smart to attach together with your tax advisor to debate options.

That stated, it is also attainable that these incentives will stay whereas others for fossil fuel-related power tasks will return. The president-elect has expressed support for U.S. power independence, and he named North Dakota Gov. Doug Burgum — who helps each oil and renewable manufacturing — his selection to guide a brand new Nationwide Power Council.

Methods to put together

Right here is the excellent news. Whereas most entrepreneurs have little affect over how these insurance policies will shake out following the inauguration, the basics of making a great tax technique won’t change.

Bear in mind: Your tax is predicated in your distinctive set of information. To vary your tax, you simply want to alter your information.

How do you do that? The tax regulation is a collection of incentives designed to affect how individuals earn and make investments their cash. The hot button is to concentrate to how the tax regulation modifications and shift your technique accordingly. Keep knowledgeable and work with an advisor who will associate with you on a long-term method to attenuate taxes whereas maximizing your wealth.