Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Final month, new Treasury Secretary Scott Bessent stated that the Federal Nationwide Mortgage Affiliation (Fannie Mae) and the Federal House Mortgage Mortgage Company (Freddie Mac) might get launched from authorities conservatorship if doing so doesn’t push up mortgage charges.

“Proper now the precedence is tax coverage—as soon as we get by way of that, then we are going to take into consideration that [ending conservatorship]. The precedence for a Fannie and Freddie launch, crucial metric that I’m is any examine or trace that mortgage charges would go up. Something that’s accomplished round a secure and sound launch [of Fannie Mae and Freddie Mac] goes to hinge on the impact of long-term mortgage charges,” Bessent said.

Whereas some within the Trump administration have alluded to an curiosity in ending the conservatorship of Fannie Mae and Freddie Mac, Trump and Bessent additionally earlier expressed interest in bringing down long-term rates and yields. Bessent means that their objective of reducing mortgage charges might take priority over releasing Fannie Mae and Freddie Mac from conservatorship.

Fannie Mae and Freddie Mac, which help the mortgage trade by shopping for mortgages from lenders and promoting mortgage-backed securities to buyers, have been positioned into conservatorship by the Federal Housing Finance Company (FHFA) in September 2008. That was after they suffered large losses throughout the housing crash, which threatened the soundness of the U.S. monetary system. The U.S. Treasury supplied a bailout to maintain them afloat, and so they have remained below authorities management ever since, regardless of returning to profitability.

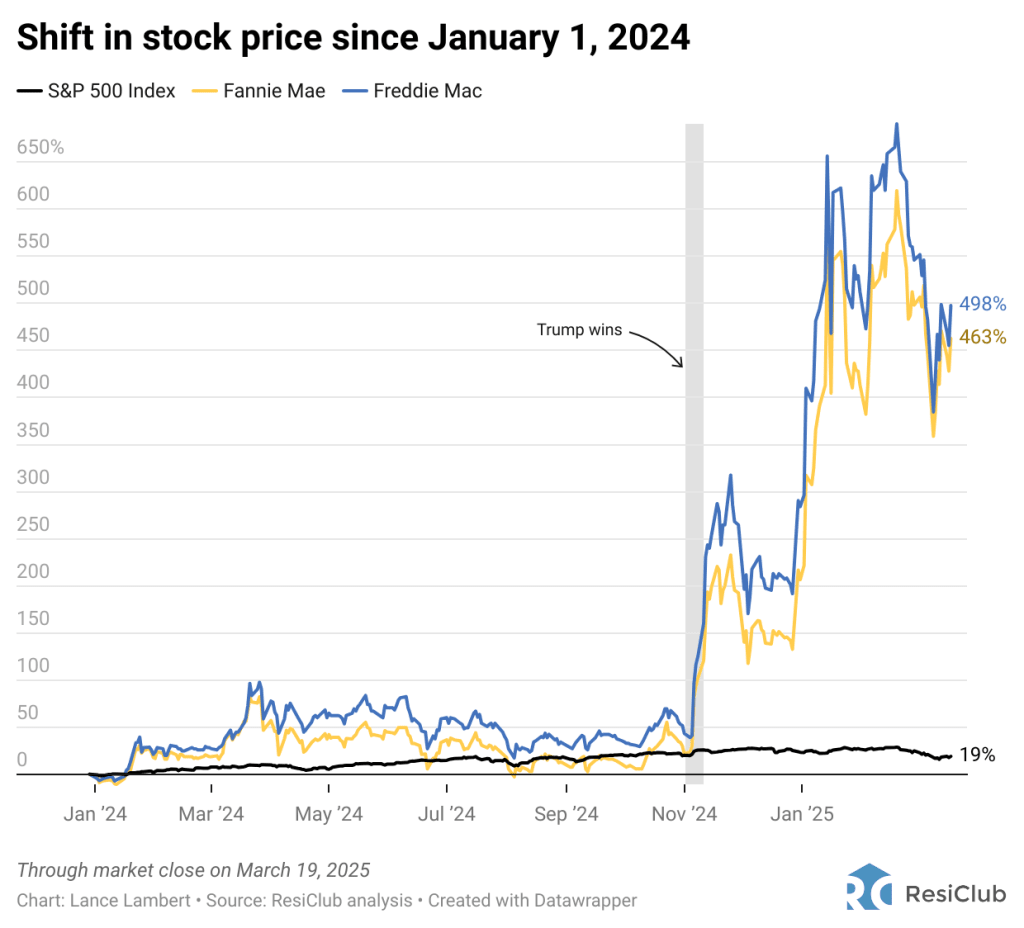

Whereas the U.S. Treasury owns the vast majority of their income by way of senior most well-liked inventory agreements, the frequent and most well-liked shares that existed earlier than conservatorship have been by no means totally worn out. Instantly following Trump’s November election win, the inventory costs of Freddie Mac and Fannie Mae each soared and the market began to cost in greater odds of conservatorship coming to an finish.

To higher perceive what the top of conservatorship for Freddie Mac and Fannie Mae might imply for the housing market and mortgage rates, ResiClub reached out to Moody’s chief economist Mark Zandi—who has revealed a number of experiences (together with in 2017 and 2025) on how the top of conservatorship might influence monetary markets.

Zandi supplied ResiClub along with his odds for 5 situations and the way every might influence mortgage charges, together with whether or not the federal government affords an “implicit” or “specific” assure of Fannie and Freddie.

An “specific assure” means the federal government formally ensures Fannie Mae and Freddie Mac’s obligations, making certain that buyers can be repaid it doesn’t matter what. This reduces danger for buyers, resulting in decrease mortgage charges. An “implicit assure” means the federal government doesn’t decide to backing the GSEs, however markets assume it will intervene to forestall failure. (This was the case earlier than the 2008 monetary disaster when buyers believed the federal government would rescue the GSEs if wanted.) Since there’s no formal assure, this situation can result in greater borrowing prices as a result of buyers demand additional compensation for the uncertainty.

1. Conservatorship established order stays in place: 65% chance

“The established order with the [Government-Sponsored Enterprises] remaining in conservatorship is the most probably situation,” Zandi tells ResiClub. “That is the most probably situation as it’s according to the established order and present mortgage charges. The housing finance system has labored very effectively because the GSEs have been put into conservatorship in 2008. And the GSEs have been successfully privatized by way of their credit score danger transfers to the non-public sector. These advocating for taking the GSEs out of conservatorship want to clarify what the advantage of privatization is.”

2. Launch of Freddie Mac and Fannie Mae with an “implicit authorities assure”: 20% chance

“Launch of the GSEs as systemically essential monetary establishments (SIFIs) with an implicit authorities assure like that which prevailed previous to the GSEs’ conservatorship,” says Zandi. “That is going again to the longer term, and whereas the GSEs can be higher capitalized and with a a lot smaller and fewer dangerous steadiness sheet than once they failed, international buyers can be extremely cautious of this method, pushing mortgage charges up 20-40 foundation factors in comparison with the established order for the standard borrower by way of the enterprise cycle. Given the nightmares this may conjure up, it’s a much less seemingly situation.”

3. Full launch of Freddie Mac and Fannie Mae with out an “implicit” or “specific” authorities assure: 10% chance

“This might add an estimated 60-90 foundation factors to 30-year mounted mortgage charges in comparison with the present established order for the standard borrower by way of the enterprise cycle,” Zandi tasks. “With out a authorities assure, the Federal Reserve wouldn’t have the ability to purchase the GSEs’ [mortgage-backed securities], and there’s the chance that the ranking companies would downgrade the GSEs’ debt and securities. The GSEs’ share of the mortgage market would considerably decline, and it will improve for personal lenders and the [Federal Housing Administration], leading to higher taxpayer publicity, as taxpayers bear all the chance in FHA loans.”

4. Launch of Freddie Mac and Fannie Mae with an “specific” authorities assure: 5% chance

“Launch of the GSEs with an specific authorities assure would lead to a small decline in mortgage charges (as a lot as 25 foundation factors) in comparison with the present established order. However this isn’t seemingly as it will require laws that might be troublesome and [nearly] unattainable to go,” says Zandi.

5. Freddie Mac and Fannie Mae totally chartered as authorities firms: 0% chance

“[If the] GSEs are chartered as authorities firms (very like Fannie pre-1968) with an specific authorities assure, [this] would successfully codify the present established order to get the total religion and credit score assure of the federal authorities. This might outcome within the lowest mortgage charges, but in addition requires laws and isn’t in any respect seemingly in a Trump administration,” says Zandi.

Whereas the Trump administration is fascinated with releasing Freddie Mac and Fannie Mae from conservatorship, additionally it is delicate to any improve in mortgage charges. Given this concern and the proof introduced by Moody’s, it’s honest to imagine that the administration will proceed with warning over the following 12 months. If conservatorship does finish, it’s more likely to occur later within the Trump administration, as soon as issues round mortgage charges have been addressed.