Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Michael Zuber started constructing his rental property portfolio in Fresno, beginning along with his first properties in 2001. He bought off a lot of his actual property portfolio proper earlier than the 2008 housing bust after which reentered the market after house costs crashed.

By 2018, Zuber had grown his portfolio to greater than 170 rental properties and made the choice to go away his tech job in Silicon Valley to deal with his ardour for serving to others obtain comparable success. His YouTube channel, One Rental at a Time, has since amassed greater than 60,000 followers, most of whom are single-family landlords themselves.

Zuber research the monetary and housing market day by day and has change into a number one voice within the mom-and-pop landlord space—which represents the biggest share of rental-property house owners within the U.S.

ResiClub‘s Meghan Malas not too long ago interviewed Zuber about his insights and method.

Rates of interest have gone up rather a lot since early 2021, so plenty of institutional capital that was shifting into the area has pulled again. Nevertheless, we’re nonetheless seeing, on a share foundation, an excellent variety of single-family landlord purchases from mom-and-pop single-family landlords. How are single-family buyers nonetheless discovering offers that pencil in this sort of market?

Mother-and-pop landlords have a bonus over Wall Road cash as a result of they’re way more nimble. They solely want to search out one property versus dozens, making it simpler in right this moment’s surroundings to search out the needle within the haystack. Institutional buyers nowadays deal with newer properties, typically lower than a decade previous, with three or 4 bedrooms.

Mother-and-pop landlords can goal properties that don’t match the institutional “purchase” field, discovering ugly ducklings or missed listings. And whereas establishments depend on expertise to question the marketplace for offers, mom-and-pop landlords community and consider offers regionally.

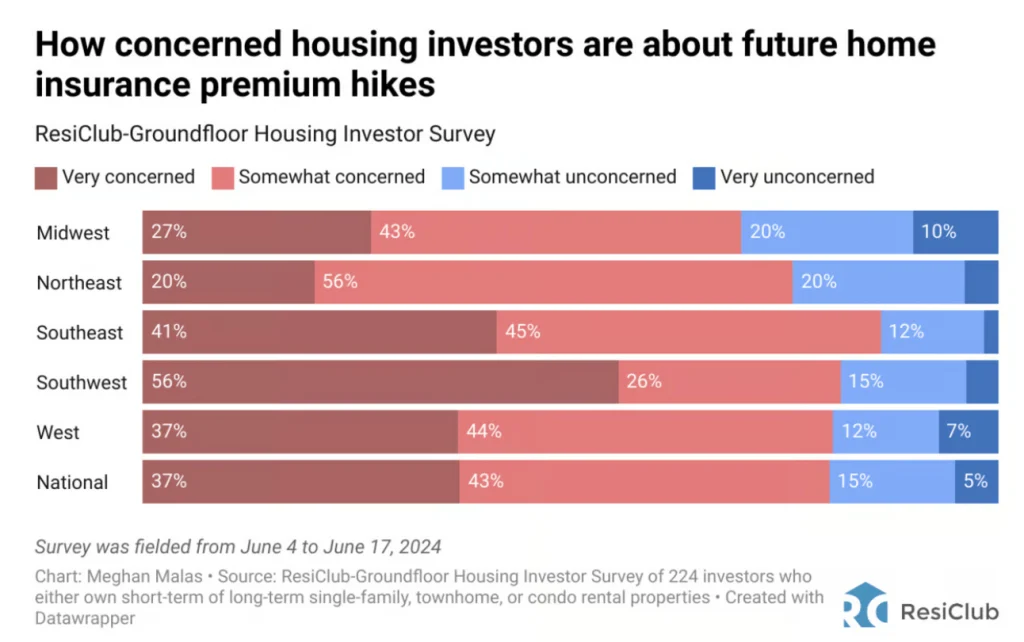

Again in June, a ResiClub-Groundfloor Housing Investor Survey discovered that 80% of actual property investor-landlords are involved about house insurance coverage shocks. What ought to single-family buyers be conscious of on the insurance coverage entrance?

Insurance coverage has change into a front-and-center challenge for landlords. For over 25 years, I might estimate my insurance coverage prices inside $20 or $30. However within the final two years, we began dealing with nonrenewals and cancellations. In California, there was a interval when insurance coverage firms have been leaving the market altogether.

For years, I had a fourplex the place insurance coverage was constantly round $1,900. When my supplier refused to resume, the following service charged virtually $3,200 for a similar protection.

Fortunately, within the final six months, the speed shocks, cancellations, and nonrenewals appear to be easing. And for those who’ve been within the recreation lengthy sufficient, you’ve possible benefited from vital hire will increase between 2020 and 2023. Whereas insurance coverage prices may need jumped 50%, these hire will increase have typically outpaced them.

So long as you’re managing your items successfully, the upper insurance coverage prices—whereas they harm money move—are manageable.

You’ve mentioned earlier than that right this moment’s housing market resembles that of the early Eighties—a time of considerably strained housing affordability within the U.S.—are you able to clarify why?

Between 1978 and 1982, we noticed a dramatic enhance in charges, which sharply decreased transactions. I made this name in 2022 proper after the Jackson Gap assembly, the place Jerome Powell primarily mentioned, “Ache is coming.”

In my 54-year spreadsheet, you’ll be able to see the sample: From 1978 to 1981, current house gross sales transactions went down 50%, however the median house worth went up.

In 2022, after I predicted a crash in housing transactions alongside rising [national home] costs, many dismissed it as silly. Sadly, that’s precisely what occurred.

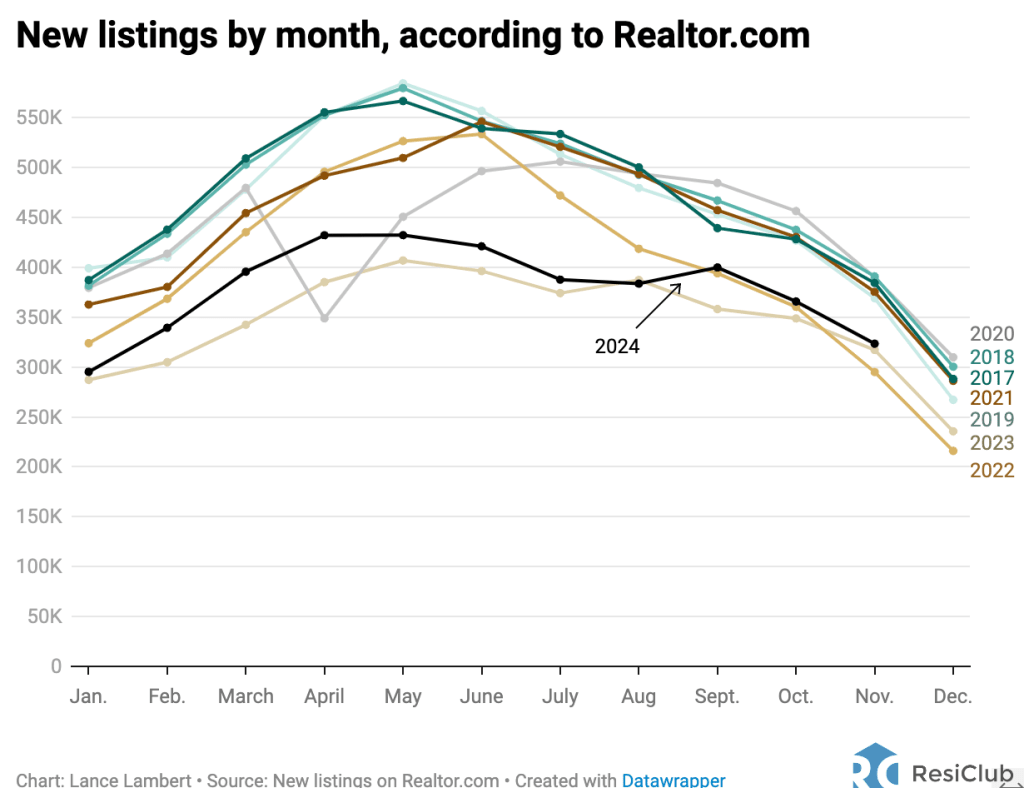

Even earlier than current house gross sales—and new listings—plummeted in 2022, you mentioned that the “Fed broke the housing market.” What did you imply by that, and is that also true heading into 2025?

Historically, the housing market follows a standard cycle. First-time homebuyers buy a house, keep for six to eight years, after which transfer up. This cycle operated constantly for 40 years.

However think about somebody who purchased an entry-level house in 2020 or 2021. Immediately, it’s possible they might not afford their present house on account of its worth enhance of 25% to 50%, not to mention commerce up for a greater house. The maths now not works. The house they need to purchase is $100,000 dearer, and mortgage charges have jumped from 3% to 7%. Because of this, the “move-up purchaser” has successfully disappeared from the market.

The shortage of move-up consumers breaks the housing market as a result of their exercise represents two transactions—a sale and a purchase order. With out them, entry-level housing stays frozen. The properties promoting are higher-end or luxurious properties, which skews the market. Median house costs seem increased as a result of lower-priced properties aren’t [selling].

Evaluating what number of entry-level properties bought in 2019 or 2020 to gross sales in 2024 or 2025 reveals a big drop—round 30% fewer. That is what defines a damaged housing market.

What’s your outlook for the housing market in 2025?

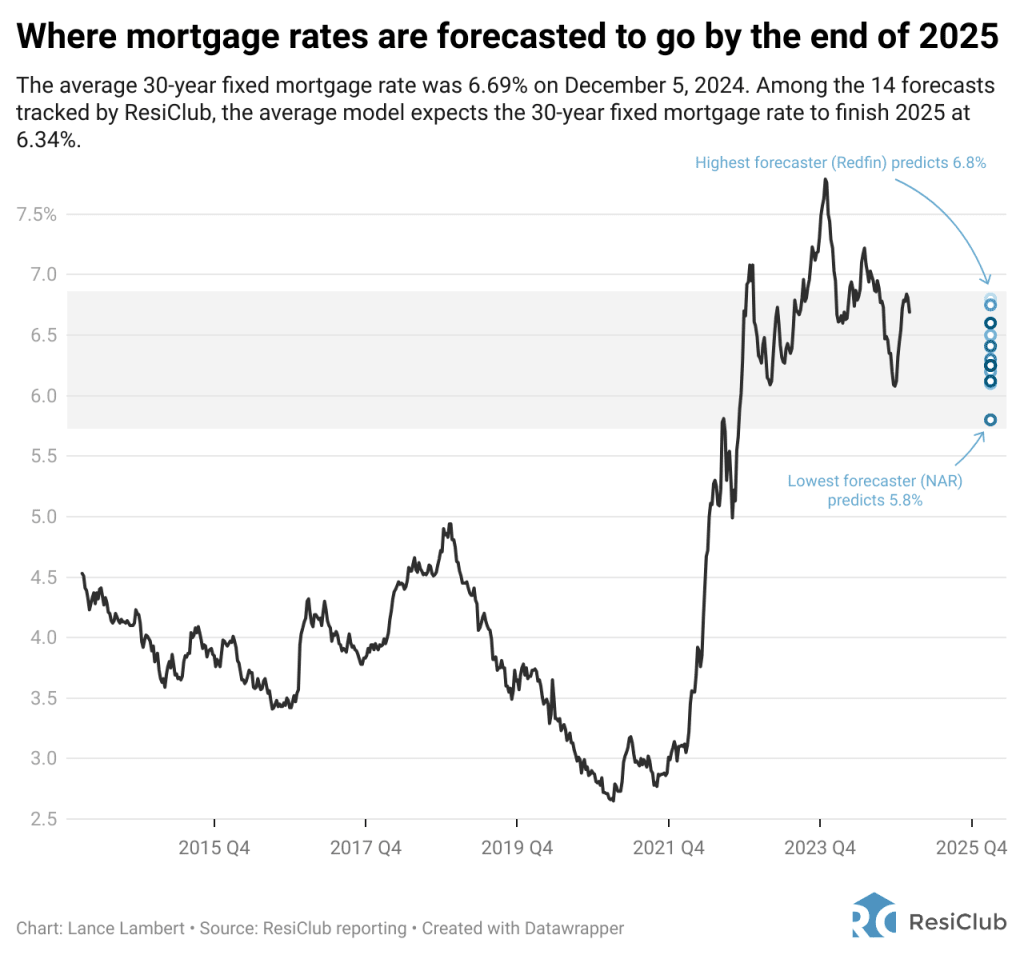

My name for 2025 is basically “increased for longer.” Charges is likely to be decrease on the finish of the yr than firstly, however on common, 7% appears possible.

Virtually nobody with a 3% mortgage on an entry-level house will commerce as much as a 7% price—it merely doesn’t make monetary sense. Because of this, 2025 will possible be one other sluggish yr with low transaction quantity. I count on nationwide house costs to remain flat, rising by 1% or 2% in 2025.

I predict extra new house gross sales in 2025, however sq. footage will shrink. Builders are prone to deal with smaller, entry-level properties.

I additionally consider the incoming administration will work to make housing development quicker and cheaper, presumably providing incentives for constructing entry-level housing. I don’t foresee any “free cash” first-time homebuyer packages. The very last thing the market wants is extra demand; we’d like provide. If such a program materializes, my name for 2025 can be improper, as it could disrupt the present dynamics.

Many individuals see actual property as a strategy to construct wealth for retirement, however they don’t need to handle properties ceaselessly. As somebody who as soon as owned over 170 leases, when did you determine to downsize, and the way did you intend your exit?

You don’t should self-manage. From the start, [my wife and I] selected to spend money on a market two and a half hours away whereas working demanding full-time jobs. Property administration was a necessity for us, so we discovered offers that would help paying a ten% administration charge.

Whereas we now not pay 10% right this moment, having property managers from Day One has helped scale back the operational stress of direct administration. That mentioned, managing the supervisor remains to be important. We’ve needed to fireplace property managers, cope with theft, and oversee operations to make sure all the pieces ran easily.

Nevertheless, we’ve by no means spoken on to tenants, collected hire, or referred to as for repairs. We’ve at all times paid another person to deal with these duties.

As you method retirement, different issues come into play. For instance, must you promote older properties and use a 1031 alternate to amass newer ones? Newer properties sometimes require much less administration, which may considerably scale back complications. A 1031 alternate additionally means that you can consolidate a number of properties right into a single, higher-quality asset.