Turo, a automobile rental start-up in San Francisco, has been making an attempt to go public since 2021. However a risky inventory market in early 2022 delayed its itemizing. Since then, the corporate has waited for the proper second.

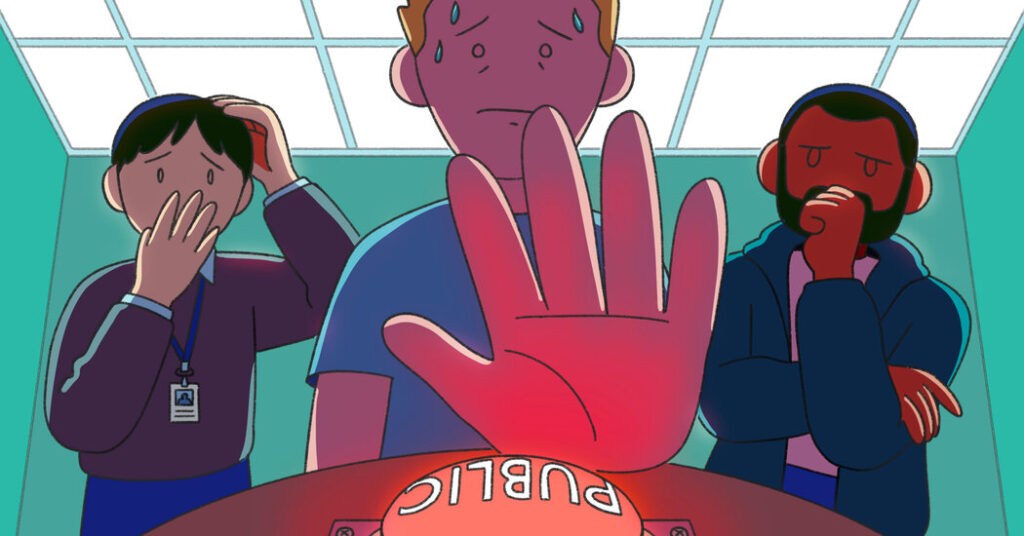

Final week, Turo pulled its itemizing completely. “Now shouldn’t be the proper time,” Andre Haddad, the corporate’s chief govt, mentioned in an announcement.

For months, buyers have eagerly anticipated a wave of preliminary public choices, spurred by President Trump’s new administration. Since his election victory in November, which ended a tumultuous marketing campaign season, Company America and Wall Road have heralded the beginning of a pro-business, anti-regulation interval. The inventory market soared forward of an anticipated bonanza of deal making.

However the administration’s tariff bulletins and rapid-fire regulatory adjustments have created uncertainty and volatility. Worsening inflation has set off market jitters. And the emergence of the Chinese language synthetic intelligence app DeepSeek last month prompted buyers to query their optimistic bets on U.S. tech, resulting in a drastic sell-off among A.I.-related stocks.

All that has affected preliminary public choices. “The calendar simply went from totally booked to being broad open in a span of like three weeks,” mentioned Phil Haslett, a founding father of EquityZen, a website that helps personal firms and their staff promote their inventory.

To this point this yr, the tempo of public choices is forward of final yr’s, with firms elevating $6.6 billion from listings, up 14 % in contrast with this time final yr, in accordance with Renaissance Capital, which manages I.P.O.-focused trade traded funds.

But there aren’t any indicators of the I.P.O. wave that many had anticipated, particularly from big-name firms that had spent the previous two years ready to go public. Other than Turo’s canceled itemizing, Cerebras, an A.I. chip firm that filed its investment prospectus this past fall, has additionally delayed plans to go public.

It’s too early to know if macroeconomic considerations about inflation, rates of interest and geopolitical dangers will trigger different firms to alter their plans, I.P.O. advisers and analysts mentioned. Extra listings are anticipated within the second half of the yr.

“We do want to permit a bit of extra time to see the place the administration begins to land on a few of these key subjects which might be driving a few of the uncertainty,” mentioned Rachel Gerring, the I.P.O. chief for Americas at EY, an accounting {and professional} providers agency. “I.P.O. planning remains to be very a lot occurring.”

Klarna, a lending start-up, and eToro, an funding and buying and selling supplier, have confidentially filed to checklist their shares in latest months. However most of the most dear personal tech firms, together with Stripe and Databricks, have indicated that they plan to remain personal for now by elevating capital from the personal market as an alternative.

David Solomon, the chief govt of Goldman Sachs, mentioned final month that one purpose I.P.O. exercise had been sluggish was that start-ups may get the capital they wanted from personal buyers. Goldman helped Stripe, the funds start-up valued at $70 billion, elevate billions of {dollars} final yr, he mentioned.

“That’s an organization that by no means would have been a non-public firm at present, given their capital wants, however at present you’ll be able to,” he mentioned at a conference organized by Cisco.

To additional ease the stress to go public, Stripe has let its staff and shareholders promote a few of their inventory regularly for the previous few years, permitting them to money out so they don’t stress the corporate to checklist. The transactions, often known as tender affords, additionally resolve the issue of worker shares expiring and assist staff pay tax payments associated to the gross sales.

The quantity and measurement of tender choices grew in 2024, in accordance with Carta, a website that helps start-ups handle their shareholders. Carta’s clients did 77 tender affords in 2024, up from 68 in 2023. They raised $3.5 billion final yr, greater than double the $1.7 billion raised in 2023.

Databricks, an A.I. information firm, raised $10 billion from investors in December. A part of the cash went towards operations, however Databricks mentioned a few of it could even be used to let present and former staff money out and pay their taxes.

Additionally in December, Veeam, an information firm, mentioned it raised $2 billion in funding that went to current buyers. This yr, Plaid employed Goldman Sachs to lift as much as $400 million in a young supply that will permit shareholders to money out, in accordance with an individual aware of the matter.

Mr. Solomon mentioned he has typically instructed start-up founders there are three causes to go public, and two of them — elevating cash and letting shareholders promote their inventory — have been solved by the personal markets.

He suggested founders to go public “with nice warning,” since doing so will change the way in which they run their companies. “It’s not enjoyable being a public firm,” he mentioned.

Firms that wish to go public have been ready. Many postponed their plans in early 2022 when rates of interest rose and the battle in Ukraine rattled markets.

Justworks, a payroll and advantages software program supplier, was days away from pitching public buyers a couple of itemizing in January 2022 when it determined to delay. Mike Seckler, the chief working officer on the time, mentioned it was tempting to push by and checklist the shares anyway, since a lot work had gone into making ready for a public providing.

However as 2022 wore on, the market volatility and poor efficiency of firms that listed proved Justworks made the proper name, he mentioned. Justworks didn’t want the capital — it had $125 million within the financial institution — and it was worthwhile.

“It began to really feel like we’d be forcing one thing, versus capitalizing on a second of nice enthusiasm for our enterprise,” mentioned Mr. Seckler, who turned chief govt in late 2022.

Justworks ultimately scrapped its itemizing plans and doesn’t plan to attempt once more anytime quickly. “Our time will come,” Mr. Seckler mentioned.

Navan, a journey and expense administration software program maker, confidentially filed to go public in 2022 however later pulled its plans, an individual aware of the matter mentioned. The beginning-up lately went on a “non-deal” roadshow to fulfill buyers and lay the groundwork for an inventory within the second half of the yr, the individual mentioned.

StubHub, the ticketing firm, which filed to go public in 2022, can be aiming to checklist its shares someday this yr, an individual aware of the matter mentioned.

With the risky market, bankers have pushed tech firms, which are sometimes unprofitable, to discover a solution to earn money, folks aware of the conversations mentioned. Bankers need start-ups to generate at the least $200 million in annual income to attraction to public buyers. If an organization is smaller or shedding cash, buyers wish to see excessive income progress, the folks mentioned.

“The bar went up for the kind of firms that may be public,” mentioned Amy Butte, Navan’s chief monetary officer.

Sanjay Dhawan, the chief govt of SymphonyAI, a software program firm, mentioned bankers have instructed him to hit $200 million to $300 million in income earlier than going public. The corporate surpassed $400 million final yr and turned a revenue, he mentioned.

Mr. Dhawan added that he had been ready for readability from the election earlier than making I.P.O. plans.

“Now everybody is aware of what the financial insurance policies will appear to be,” he mentioned. “Everyone seems to be feeling a bit relieved to begin planning.” The volatility from DeepSeek was solely a short-term response, he added.

No less than one tech firm lately made it to the general public markets. On Thursday, SailPoint Applied sciences, a cybersecurity firm backed by the personal fairness agency Thoma Bravo, raised $1.38 billion in a public providing that valued it at round $12 billion. However its inventory fell 4 % under its I.P.O. worth of $23 a share on its first day of buying and selling.

For the general public providing market to actually get going, “it’s going to take a number of courageous firms to come back out,” Mr. Haslett of EquityZen mentioned.