A state watchdog has recognized a minimum of $7.2 million in fraudulent claims and greater than 275 instances of misconduct by state staff accused of bilking a federal program designed to assist companies in the course of the COVID-19 pandemic.

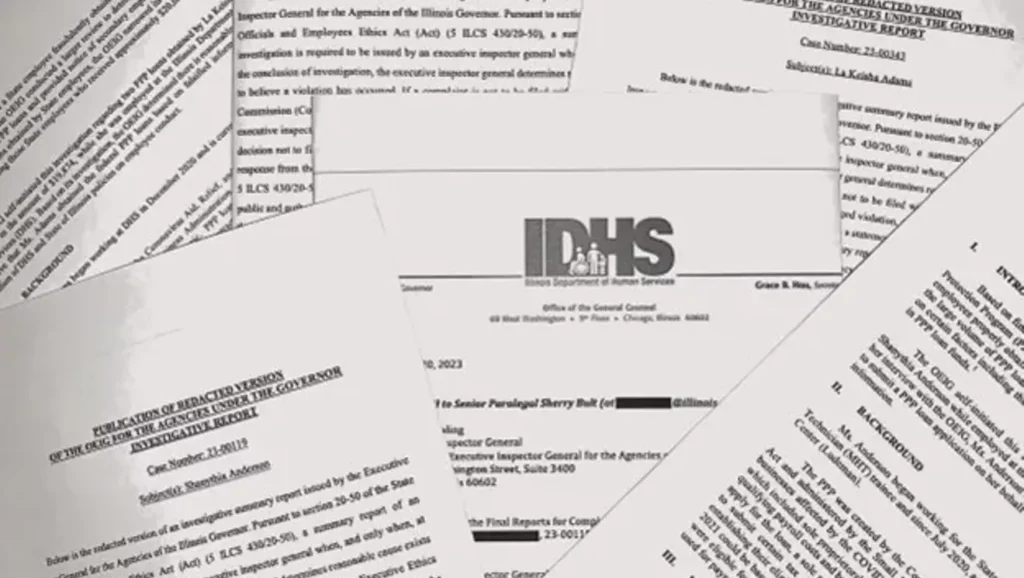

Since 2022, the Workplace of the Govt Inspector Normal has been investigating allegations that state staff fraudulently claimed Paycheck Safety Program loans for small companies they didn’t disclose or completely fabricated. State employees could interact in secondary employment, however provided that it’s disclosed and permission is granted.

Staff from 13 totally different state businesses are concerned within the fraud and have illegally taken these federal public funds, according to the OEIG, which is charged with investigating allegations of misconduct inside state authorities. As of April, greater than 60% of these implicated up to now labored for the Illinois Division of Human Providers, which operates psychological well being hospitals and developmental facilities throughout the state.

The Paycheck Safety Program was an initiative established by the federal CARES Act in 2020. The Small Enterprise Administration oversaw the implementation of the PPP to supply forgivable loans to cowl payroll prices or different bills for small companies struggling in the course of the COVID-19 pandemic. By October 2022, this system gave out $786 billion in loans and forgave 93% of them, in accordance with the SBA.

Shortly, PPP loans led to “unprecedented fraud ranges,” in accordance with the SBA inspector common. Candidates self-certified their small enterprise standing and revenue.

The OEIG is investigating solely public staff who obtained greater than roughly $20,000 from this system. To obtain a $20,000 mortgage, companies investigated by the OEIG sometimes declared $100,000 or extra of web revenue or gross revenue on the mortgage utility.

The OEIG couldn’t touch upon whether or not this investigation was near the tip. Because of the sheer dimension of this fraud, investigations contain many various businesses. In Could 2023, the Illinois legislature handed House Bill 3304, which permits legal prosecutions for COVID-19 associated fraud to start out as much as 5 years after authorities uncover the fraud.

Rep. Fred Crespo, D-Hoffman Estates, who filed the invoice, mentioned many of the routine checks equivalent to cross-referencing information on the mortgage varieties with different company databases have been suspended for this program. A big challenge was additionally the shortage of personnel.

Based on Crespo, between April 2020 and April 2022, the fraud hotline of the SBA obtained thousands and thousands of calls, of which a big quantity went unanswered.

“The vulnerabilities that led to the problems with PPP fraud weren’t actually attributable to issues on the state degree. I might say that the problems had much more to do with the unaccountable nature of this system itself,” mentioned State Rep. Mike Kelly, D-Chicago, who co-sponsored the invoice.

IDHS staff have been closely concerned within the fraud. Since 2022, a minimum of 43 staff have been discharged and 53 resigned earlier than additional motion by administration. Most often on the OEIG web site, the workers both lied about being self-employed or supplied false details about their revenue.

Information present Deborah Reynolds-Jones was a human companies caseworker who had been working for the IDHS since 2016. Reynolds-Jones instructed OEIG investigators that her barber advisable an organization that would assist her apply for the mortgage. She despatched the corporate her private info, together with her Social Safety quantity. The corporate crammed out the shape and easily requested her to signal. The knowledge was inaccurate. Reynolds-Jones paid the corporate $3,000 for his or her service after she fraudulently obtained a $20,000 PPP mortgage.

In one other case, Shanythia Anderson admitted to the OEIG that she allowed a 3rd get together to use for a PPP mortgage on her behalf and that the data supplied was inaccurate. She started working as a psychological well being technician at IDHS in 2020.

Anderson met a lady on Fb, and he or she despatched her private data. In change for this service, the girl was to obtain half of her mortgage, $10,000. Anderson labored on the Ludeman Development Center in Forest Park, the place a minimum of 36 different staff have been accused of wrongdoing.

“It occurs that in a single explicit location while you discover on the market are 37 folks that have completed this, they’ve clearly been speaking to 1 one other at work,” Gov. JB Pritzker mentioned in a information convention final yr. “Perhaps someone dedicated this type of fraud after which tried to persuade someone else.”

IDHS declined to touch upon why so a lot of its staff have been implicated. IDHS is the most important public company in Illinois, which may very well be one rationalization. Crespo mentioned that his finest guess was that public staff had early entry to the mortgage varieties, so it was simpler for them to grasp how you can file them, fraudulently or not.

“Whereas the overwhelming majority of IDHS’ roughly 14,000 state staff are hard-working individuals of robust character who work tirelessly to assist essentially the most weak, it’s deeply regarding any time an worker takes benefit of public applications,” IDHS mentioned in a press release.

Different state businesses the place the OEIG found multiple cases of PPP fraud included the Division of Corrections (31 instances), the Division of Kids and Household Providers (27), Tempo (10) and the Division of Healthcare and Household Providers (8).

The OEIG, by the Executive Ethics Commission, publishes reviews of wrongdoings provided that there may be proof of worker misconduct. It may possibly refer instances to the Legal professional Normal if the fraud is important sufficient. The Legal professional Normal, particularly the Public Integrity Bureau, then conducts its personal investigation as a way to prosecute concerned public staff.

Many instances talked about third events who utilized for the PPP mortgage on behalf of a person. The DOJ has gone after a few of these third events in Illinois, however it’s unclear that these are the identical third events that helped public staff.

In June, the a federal jury in Chicago convicted Hadi Isbaih on prices of wire fraud. Based on the DOJ, Isbaih used his firm, Flash Tax Service Inc., to file fraudulent mortgage purposes on behalf of his shoppers. Isbaih would ask for an upfront payment to file the mortgage type, and when the shopper obtained the mortgage, he would cost a further payment. A sentencing date has not but been introduced for Isbaih.

In September 2023, two Illinois businessmen have been indicted on federal prices for acquiring $7.8 million in fraudulent enterprise loans. Based on the DOJ, they recruited self-employed people to supply private info. With that, they might fill out mortgage varieties with false information by inflating the people’ revenue, for instance. They’d then cost the shoppers as much as $4,000 if the mortgage was efficiently obtained. These two haven’t been convicted.

There are extreme consequences for PPP fraud. Knowingly declaring false statements to a monetary establishment may end up in as much as 30 years in jail or a wonderful of as much as $1 million. Wire fraud, the usage of the Web or digital communication to hold out fraud, is a federal crime that may be punishable by as much as 20 years in jail.

Amalia Huot-Marchand is a graduate scholar in journalism with Northwestern College’s Medill College of Journalism, Media, Built-in Advertising and marketing Communications, and a Fellow in its Medill Illinois Information Bureau working in partnership with Capitol Information Illinois.

Capitol News Illinois is a nonprofit, nonpartisan information service that distributes state authorities protection to a whole lot of reports retailers statewide. It’s funded primarily by the Illinois Press Basis and the Robert R. McCormick Basis.