A big portion of Nvidia’s development this quarter was pushed by knowledge middle income, totaling $30.8 billion for the quarter, which was up 112 % from final yr. The corporate’s gross revenue margin was 74.5 %, basically flat from a yr in the past. However analysts anticipate that Nvidia’s margins might shrink as the corporate shifts to producing extra Blackwell chips, which value extra to make than their much less superior predecessors.

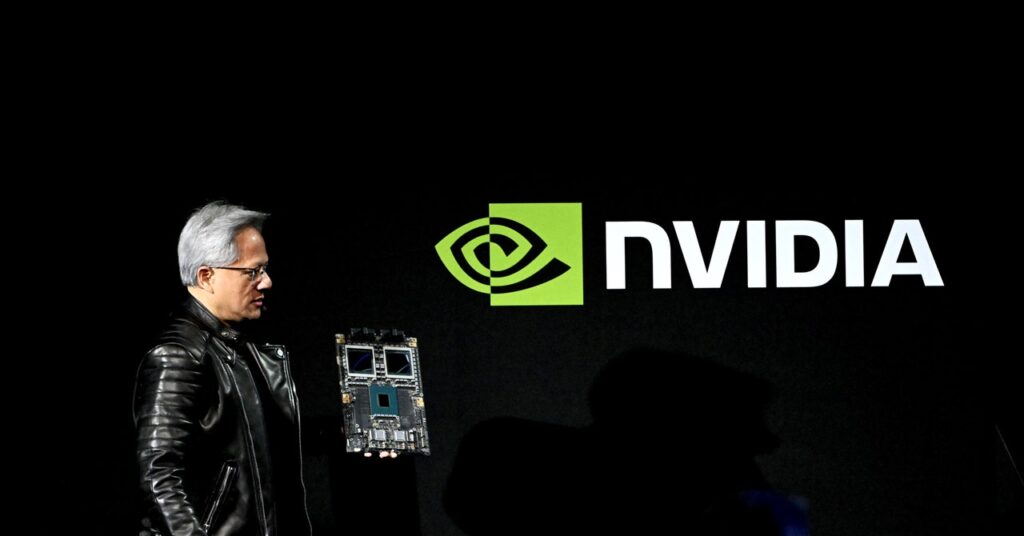

Nvidia’s earnings reviews are seen as an necessary bellwether for the AI business as a complete. The chip architect’s superior GPUs, which energy advanced neural network processing, are what made the present generative AI growth doable. As Silicon Valley giants raced to construct new chatbots and image-generation instruments over the previous few years, Nvidia’s income exploded, permitting it to surpass Apple as probably the most precious public firm on the planet. For the reason that launch of ChatGPT in November of 2022, Nvidia’s inventory value has elevated practically tenfold.

Virtually each main tech firm engaged on AI, even these building their own processing units, rely closely on Nvidia GPUs to coach their AI fashions. Meta, for instance, has mentioned that it’s constructing its newest AI expertise on a cluster of more than 100,000 Nvidia H100s. Smaller AI startups, in the meantime, have been left with out enough AI compute power as Nvidia struggled to maintain up with demand.

Blackwell, Nvidia’s latest GPU, is made up of two items of silicon every equal to the scale of its earlier chip, Hopper, that are mixed collectively right into a single element. This design has resulted in a chip that’s supposedly 4 occasions quicker and with greater than double the number of transistors as its predecessor.

However the launch of Blackwell hasn’t been easy crusing. Initially slated to ship within the second quarter, the brand new chip hit a manufacturing snag, reportedly delaying the rollout by a number of months. Huang took accountability for the issue, calling it a “design flaw” that “induced the yield to be low.” Huang informed Reuters in August that Nvidia’s longtime chipmaking accomplice, Taiwan Semiconductor Manufacturing Firm Restricted, helped Nvidia right the problem.

Moorhead informed WIRED he stays bullish on Nvidia and is assured that the generative AI market will proceed to develop for the following 12 to 18 months, no less than, regardless of some recent reports suggesting AI progress is beginning to plateau.

“I feel the one approach shareholders would have a mutiny is that if they have been involved concerning the capital expenditures or the profitability of the hyperscalers,” Moorhead mentioned, referring to huge tech firms like Amazon, Google, Microsoft, and Meta which might be closely invested in AI cloud companies. “However I feel they’re simply going to maintain shopping for up Nvidia till that day really comes.” Enterprise AI remains to be an space of development for Nvidia as nicely, he added.

On at this time’s earnings name, Nvidia chief monetary officer Colette Kress mentioned Nvidia’s enterprise AI instruments are in “full throttle,” together with an working platform that lets different companies construct their very own copilots and AI brokers. Clients embody Salesforce, SAP, and ServiceNow, she mentioned.

Huang echoed the identical factor later within the name: “We’re beginning to see enterprise adoption of agentic AI,” he mentioned. “It’s actually the newest rage.”