In mid-January, a prime United States supplies firm introduced that it had began to fabricate uncommon earth magnets. It was vital information—there aren’t any giant U.S. makers of the neodymium magnets that underpin enormous and vitally vital industrial and protection industries, together with electric vehicles. However it created barely a ripple throughout a very loud and stormy time in U.S. commerce relations.

The press launch, from MP Materials, was mild on particulars. The corporate disclosed that it had began producing the magnets, referred to as neodymium-iron-boron (NdFeB), on a “trial” foundation and that the manufacturing unit would start regularly ramping up manufacturing earlier than the tip of this yr. In line with MP’s spokesman, Matt Sloustcher, the power may have an preliminary capability of 1,000 tonnes each year, and has the infrastructure in place to scale as much as 2,000 to three,000 tonnes per yr. The discharge additionally mentioned that the power, in Fort Value, Texas, would provide magnets to General Motors and different U.S. producers.

NdFeB magnets are probably the most highly effective and worthwhile kind. They’re utilized in motors for electric vehicles and for heating, ventilating, and cooling (HVAC) techniques, in wind-turbine mills, in instruments and appliances, and in audio audio system, amongst different gear. They’re additionally crucial elements of numerous military systems and platforms, together with fighter and bomber plane, submarines, precision guided weapons, night-vision techniques, and radars.

A magnet manufacturing surge fueled by Protection {dollars}

MP Supplies’ has named its new, state-of-the-art magnet manufacturing facility Independence.Enterprise Wire

The Texas facility, which MP Materials has named Independence, just isn’t the one main rare-earth-magnet undertaking within the U.S. Most notably, Vacuumschmelze GmbH, a magnet maker based mostly in Hanau, Germany, has begun establishing a plant in South Carolina by way of a North American subsidiary, e-VAC Magnetics. To construct the US $500 million manufacturing unit, the corporate secured $335 million in exterior funds, together with not less than $100 million from the U.S. authorities. (E-VAC, too, has touted a provide settlement with Basic Motors for its future magnets.)

In one other intriguing U.S. rare-earth magnet undertaking, Noveon Magnetics, in San Marcos, Texas, is at the moment producing what it claims are “industrial portions” of NdFeB magnets. Nonetheless, the corporate just isn’t making the magnets in the usual method, beginning with steel alloys, however moderately in a singular course of based mostly on recycling the supplies from discarded magnets. USA Rare Earth announced on 8 January that it had manufactured a small quantity of NdFeB magnets at a plant in Stillwater, Oklahoma.

One more firm, Quadrant Magnetics, introduced in January, 2022, that it will start building on a $100 million NdFeB magnet manufacturing unit in Louisville, Kentucky. Nonetheless, 11 months later, U.S. federal brokers arrested three of the company’s top executives, charging them with passing off Chinese language-made magnets as domestically produced and giving confidential U.S. army information to Chinese language companies.

The a number of US neodymium-magnet tasks are noteworthy however even collectively they received’t make a noticeable dent in China’s dominance. “Let me provide you with a actuality test,” says Steve Constantinides, an IEEE member and magnet-industry marketing consultant based mostly in Honeoye, N.Y. “The entire manufacturing of neo magnets was someplace between 220 and 240 thousand tonnes in 2024,” he says, including that 85 p.c of the whole, not less than, was produced in China. And “the 15 p.c that was not made in China was made in Japan, primarily, or in Vietnam.” (Different estimates put China’s share of the neodymium magnet market as excessive as 90 p.c.)

However have a look at the figures from a unique angle, suggests MP Supplies’s Sloustcher. “The U.S. imports simply 7,000 tonnes of NdFeB magnets per yr,” he factors out. “So in whole, these [U.S.] amenities can supplant a major proportion of U.S. imports, assist re-start an {industry}, and scale because the manufacturing of motors and different magnet-dependent industries” returns to the US, he argues.

And but, it’s laborious to not be somewhat awed by China’s supremacy. The nation has some 300 producers of rare-earth permanent magnets, in response to Constantinides. The most important of those, JL MAG Rare-Earth Co. Ltd., in Ganzhou, produced not less than 25,000 tonnes of neodymium magnets final yr, Constantinides figures. (The corporate not too long ago introduced that it was constructing one other facility, to start working in 2026, that it says will convey its put in capability to 60,000 tonnes a yr.)

That 25,000 tonnes determine is akin to the mixed output of all of the rare-earth magnet makers that aren’t in China. The $500-million e-VAC plant being in-built South Carolina, for instance, is reportedly designed to supply round 1,500 tonnes a yr.

However even these numbers don’t absolutely convey China’s dominance of everlasting magnet manufacturing. The place ever a manufacturing unit is, making neodymium magnets requires provides of rare-earth steel, and that almost all the time leads straight again to China. “Although they solely produce, say, 85 p.c of the magnets, they’re producing 97 p.c of the steel” on the earth, says Constantinides. “So the magnet producers in Japan and Europe are extremely depending on the rare-earth steel coming from China.”

MP’s Mine-to-Manufacturing stragegy

And there, not less than, MP Materials could have an fascinating edge. Hardly any companies, even in China, do what MP is making an attempt: produce completed magnets beginning with ore that the corporate mines itself. Even giant firms usually carry out only one or at most two of the 4 main steps alongside the trail to creating a rare-earth magnet: mining the ore, refining the ore into rare-earth oxides, decreasing the oxides to metals, after which, lastly, utilizing the metals to make magnets. Every step is a gigantic endeavor requiring totally totally different gear, processes, data, and ability units.

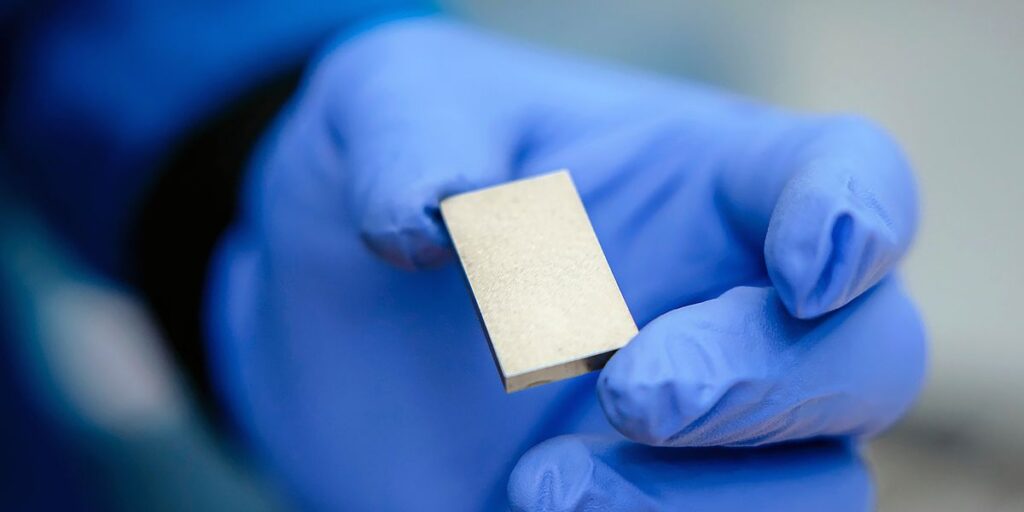

The rare earth metal produced at MP Supplies’ magnet manufacturing facility in Fort Value, Texas, consists of principally neodymium and praseodymium.Enterprise Wire

The rare earth metal produced at MP Supplies’ magnet manufacturing facility in Fort Value, Texas, consists of principally neodymium and praseodymium.Enterprise Wire

“The one benefit they get from [doing it all] is that they get higher insights into how totally different markets are literally rising,” says Stan Trout, a magnet {industry} marketing consultant in Denver, Colorado. “Getting the timing proper on any growth is vital,” Trout provides. “And so MP ought to be getting that info in addition to anyone, with the totally different vegetation that they’ve, as a result of they work together with the market in a number of alternative ways and may actually see what demand is like in actual time, moderately than as some projection in a forecast.”

Nonetheless, it’s going to be an uphill climb. “There’s are loads of each laborious and gentle subsidies within the supply chain in China,” says John Ormerod, an {industry} marketing consultant based mostly in Knoxville, Tenn. “It’s going to be tough for a US producer to compete with the present value ranges of Chinese language-made magnets,” he concludes.

And it’s not going to get higher any time quickly. China’s rare-earth magnet makers are solely utilizing about 60 p.c of their manufacturing capability, in response to each Constantinides and Ormerod—and but they’re persevering with to construct new vegetation. “There’s going to be roughly 500,000 tonnes of capability by the tip of this yr,” says Ormerod, citing figures gathered by Singapore-based analyst Thomas Kruemmer. “The demand is simply about 50 p.c of that.”

The upshot, all the analysts agree, might be downward value stress on rare earth magnets within the close to future, not less than. On the similar time, the U.S. Department of Defense has made it a requirement that rare-earth magnets for its techniques have to be produced totally, beginning with ore, in “pleasant” nations—which doesn’t embrace China. “The DoD might want to pay a premium over cheaper imported magnets to ascertain a value ground enabling home U.S. producers to efficiently and constantly provide the DoD,” says Constantinides.

However is what’s good for America good for Basic Motors, on this case? We’re all going to search out out in a yr or two. For the time being, few analysts are bullish on the prospect.

“The automotive {industry} has been extraordinarily cost-conscious, demanding provider value reductions of even fractions of a cent per piece,” notes Constantinides. And even the Trump administration’s tariffs are unlikely to change the essential math of market economics, he provides. “The appliance of tariffs to magnets in an try and ‘stage the enjoying area’ incentivizes firms to search out work-arounds, reminiscent of exporting magnets from China to Malaysia or Mexico, then re-exporting from there to the USA. This isn’t theoretical, these work-arounds have been used for many years to keep away from even the previous or present low tariff charges of about 3.5 p.c.”

From Your Website Articles

Associated Articles Across the Internet