Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

In the course of the Pandemic Housing Increase, housing demand surged quickly amid ultralow rates of interest, stimulus, and the distant work growth—which elevated demand for house and unlocked “WFH arbitrage” as excessive earners have been in a position to maintain their revenue from a job in say, NYC or L.A., and purchase in say Austin or Tampa. Federal Reserve researchers estimate “new development would have needed to improve by roughly 300% to soak up the pandemic-era surge in demand.” In contrast to housing demand, housing stock supply isn’t as elastic and may’t ramp up as shortly. Consequently, the heightened pandemic period demand drained the market of energetic stock and overheated dwelling costs, with U.S. home prices rising a staggering 43.2% between March 2020 and June 2022.

Whereas many commentators view energetic stock and months of provide merely as measures of “provide,” ResiClub sees them extra as proxies for the supply-demand equilibrium. As a result of housing demand is extra elastic than housing inventory, massive swings in energetic stock or months of provide are often pushed by shifts in demand. For instance, through the Pandemic Housing Increase, surging demand precipitated houses to promote sooner—pushing energetic stock down, at the same time as new listings remained regular. Conversely, lately, weakening demand has led to slower gross sales, inflicting energetic stock to rise—at the same time as new listings fell under pattern.

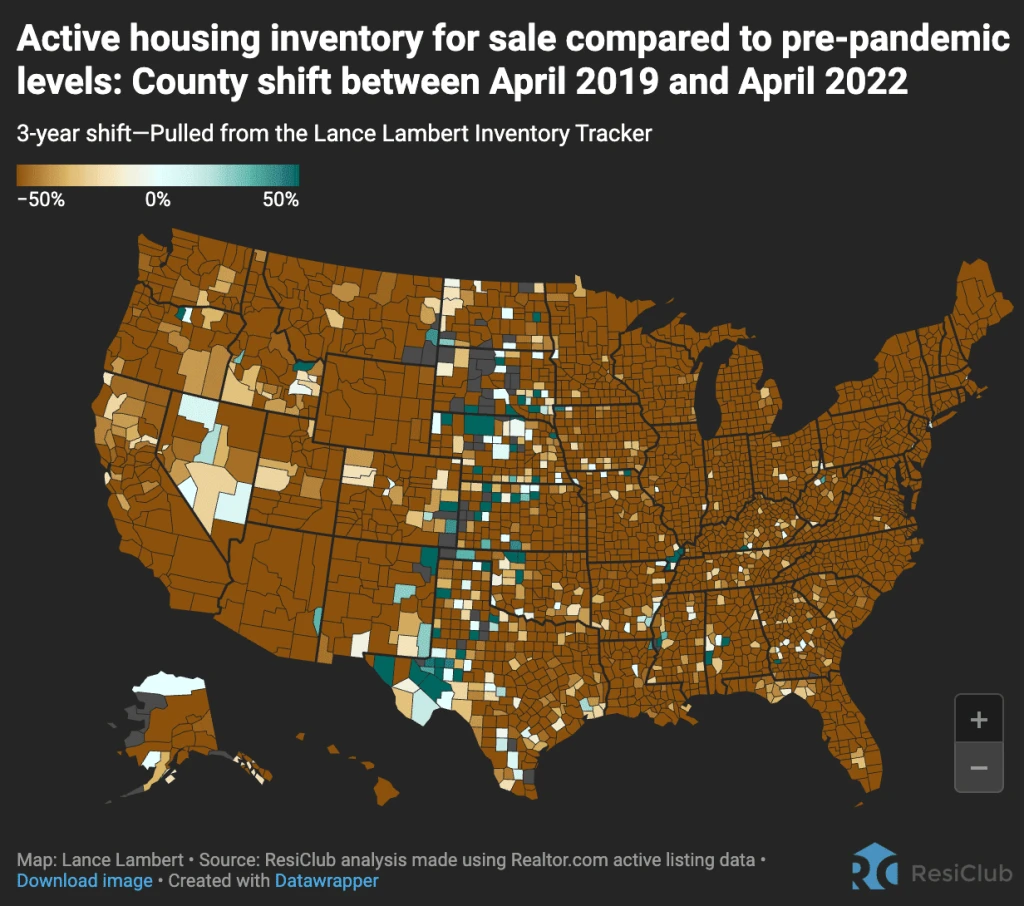

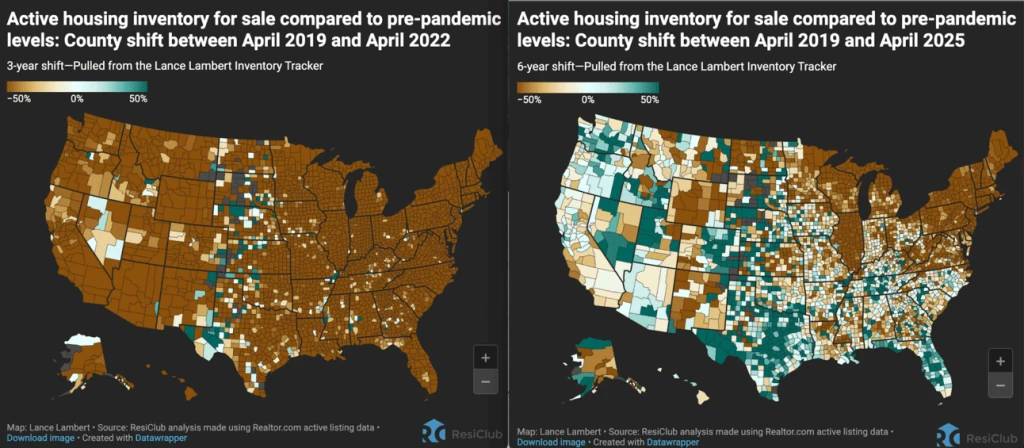

Certainly, through the ravenous housing demand on the peak of the Pandemic Housing Increase in April 2022, nearly your complete nation was at the very least -50% under pre-pandemic 2019 energetic stock ranges.

BROWN = Energetic housing stock on the market in April 2022 was BELOW pre-pandemic 2019 ranges

GREEN = Energetic housing stock on the market in April 2022 was ABOVE pre-pandemic 2019 ranges

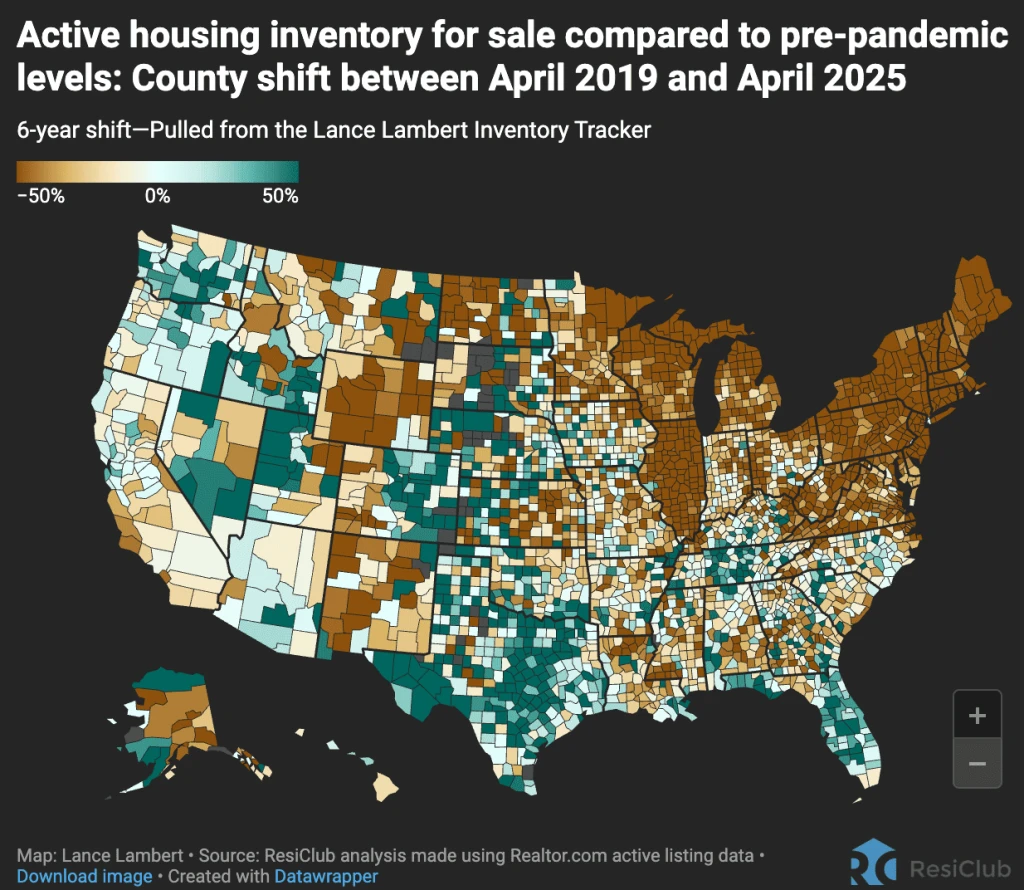

After all, now it’s a unique image: Nationwide energetic stock is on a multiyear rise.

Not lengthy after mortgage charges spiked in 2022—inflicting affordability to replicate the fact of the sharp dwelling value will increase through the Pandemic Housing Increase—and return-to-office gained a little bit of momentum, nationwide demand within the for-sale market pulled again and the Pandemic Housing Increase fizzled out. Initially, within the second half of 2022, that housing demand pullback triggered a “fever breaking” in quite a lot of markets—notably in rate-sensitive West Coast housing markets and in pandemic boomtowns like Austin and Boise—inflicting energetic stock to spike and pushing these markets into correction-mode within the second half of 2022.

Heading into 2023, a lot of those self same Western and pandemic boomtown markets (excluding Austin) stabilized, because the spring seasonal demand—coupled with still-tight energetic stock ranges—was sufficient to quickly agency up the market. For a bit, nationwide energetic stock stopped rising year-over-year.

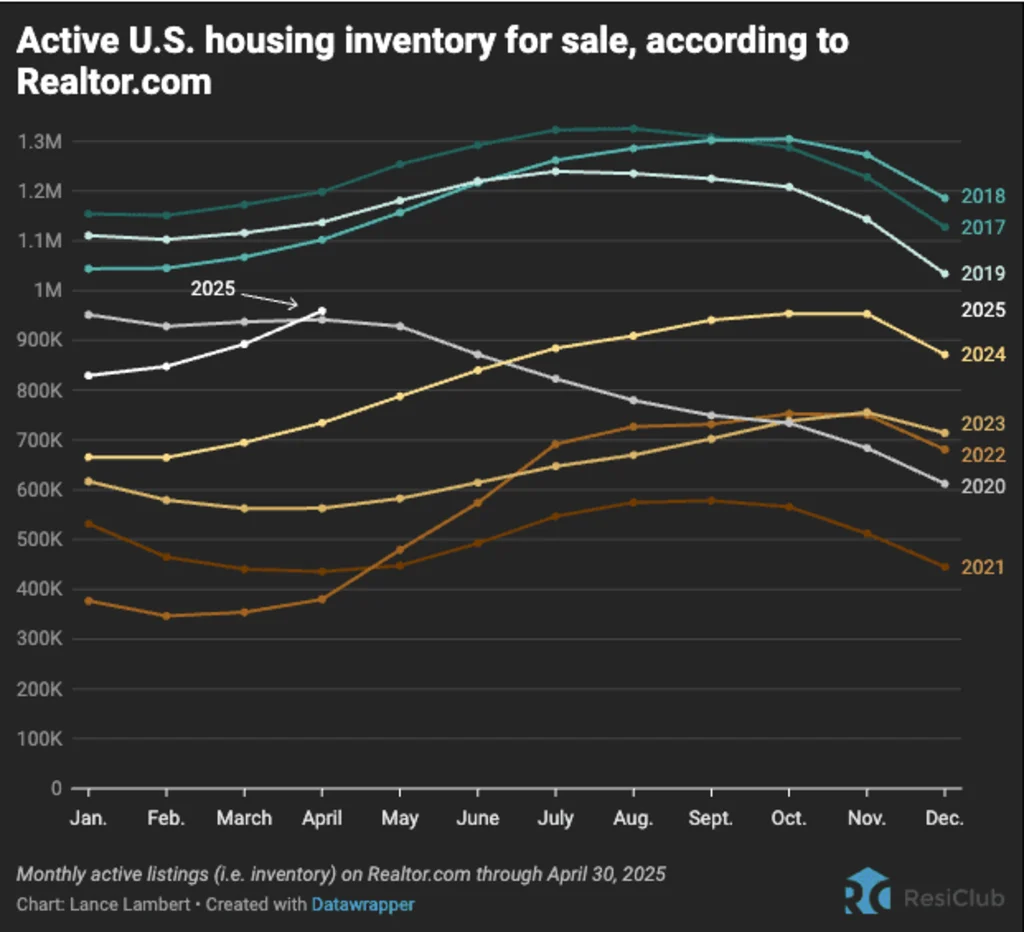

Nonetheless, that interval of nationwide stock stabilization didn’t final. Amid nonetheless slumped housing demand, nationwide energetic stock started to rise once more—and we’re now within the midst of an 18-month streak of year-over-year will increase in nationwide energetic listings.

The place energetic stock/months of provide has risen essentially the most, homebuyers have gained essentially the most leverage. Generally speaking, housing markets the place stock (i.e., energetic listings) has returned to pre-pandemic 2019 ranges have skilled weaker dwelling value development (or outright declines) over the previous 34 months. Conversely, housing markets the place stock stays far under pre-pandemic 2019 ranges have, typically talking, skilled stronger dwelling value development over the previous 34 months.

BROWN = Energetic housing stock on the market in April 2025 was BELOW pre-pandemic 2019 ranges

GREEN = Energetic housing stock on the market in April 2025 was ABOVE pre-pandemic 2019 ranges

As ResiClub has intently documented, that image varies considerably throughout the nation: a lot of the Northeast and Midwest stay under pre-pandemic 2019 stock ranges, whereas many elements of the Mountain West and Gulf areas have bounced again.

Lots of the softest housing markets, the place homebuyers have gained leverage, are situated in Gulf Coast and Mountain West areas. These areas have been among the many nation’s high pandemic boomtowns, having skilled important dwelling value development through the Pandemic Housing Increase, which stretched housing fundamentals far past native revenue ranges. When pandemic-fueled home migration slowed and mortgage charges spiked, markets like Cape Coral, Florida, and San Antonio, Texas, confronted challenges as they needed to depend on native incomes to maintain frothy dwelling costs. The housing market softening in these areas was additional accelerated by greater ranges of latest dwelling provide within the pipeline throughout the Solar Belt. Builders in these areas are sometimes prepared to scale back costs or make different affordability changes to take care of gross sales in a shifted atmosphere. These changes within the new development market additionally create a cooling impact on the resale market, as some consumers who may need opted for an present dwelling shift their focus to new houses the place offers are nonetheless out there.

In distinction, many Northeast and Midwest markets have been much less reliant on pandemic migration and have much less new dwelling development in progress. With decrease publicity to that home migration pullback demand shock—and fewer builders doing massive affordability changes to maneuver product—energetic stock in these Midwest and Northeast areas has remained comparatively tight—with dwelling sellers retaining extra energy relative to their friends within the Gulf and Mountain West areas.

Whereas national active inventory on the finish of April 2025 was nonetheless -16% under pre-pandemic April 2019, ResiClub expects nationwide energetic stock to surpass pre-pandemic 2019 ranges later this 12 months.

Huge image: The housing market remains to be present process a technique of normalization following the surge in housing demand through the Pandemic Housing Increase, when dwelling costs went up too quick, too shortly. To this point, that normalization course of has pushed some markets—together with Austin (mid-2022-present), Las Vegas (second half of 2022), Phoenix (second half of 2022), San Francisco (second half of 2022), Boise (mid-2022–2023), Punta Gorda (2022–current), Cape Coral (2023–current), and Tampa (2024–current)—into correction-mode. In another areas, up to now, it has precipitated dwelling value development to stall out. In the meantime, some markets nonetheless stay tight and have solely seen a deceleration in dwelling value development from the highs of the Pandemic Housing Increase.

ResiClub PRO members can entry my newest month-to-month stock evaluation (+800 metros and +3,000 counties) here, and my newest month-to-month dwelling value evaluation (+800 metros and +3,000 counties) here.