Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

When assessing house worth momentum, it’s vital to observe energetic listings and months of provide. If energetic listings begin to quickly improve as houses stay available on the market for longer intervals, it might point out potential future pricing weak point. Conversely, a fast decline in energetic listings may counsel a market that’s heating up.

Typically talking, native housing markets the place energetic stock has returned to pre-pandemic ranges have experienced softer home price growth (or outright worth declines) over the previous three years. Conversely, native housing markets the place energetic stock stays far beneath pre-pandemic ranges have typically skilled stronger house worth development over the previous three years.

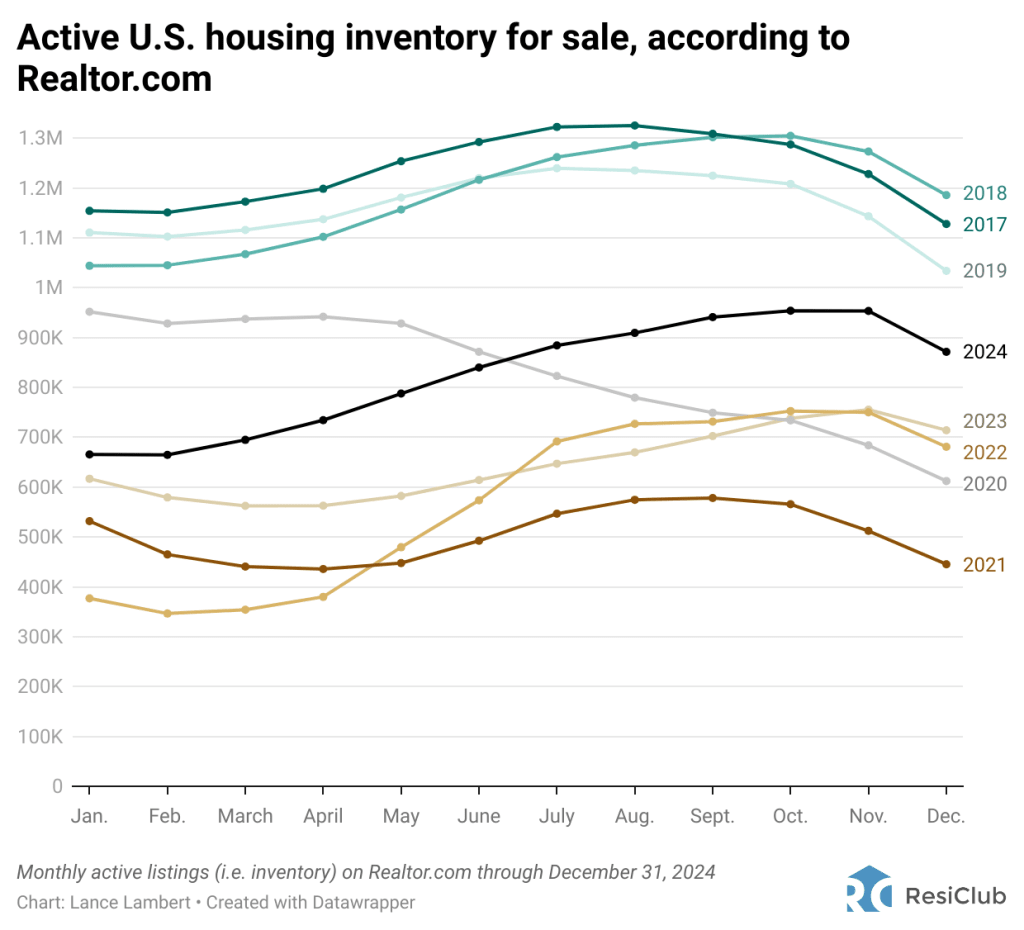

Nationwide energetic listings are on the rise (up 22% between December 2023 and December 2024). This means that homebuyers have gained some leverage in lots of components of the nation over the previous 12 months, with some markets even feeling like patrons’ markets on the bottom.

Nonetheless, nationally, we’re nonetheless beneath pre-pandemic energetic stock ranges (-15.7% beneath December 2019), and a few resale markets nonetheless stay tight—however that’s not the case anymore in lots of pockets of the Solar Belt and Mountain West.

Listed here are the historic totals for December stock/energetic listings, in response to Realtor.com:

December 2017: 1,127,799

December 2018: 1,185,865

December 2019: 1,033,887

December 2020: 612,300 (overheating through the pandemic housing increase)

December 2021: 445,303 (overheating through the pandemic housing increase)

December 2022: 680,925 (mortgage fee shock)

December 2023: 714,176

December 2024: 871,509

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r=0;r<e.size;r++)if(e[r].contentWindow===a.supply){var i=a.knowledge["datawrapper-height"][t]+"px";e[r].fashion.peak=i}}}))}();

Among the many states with the most important stock jumps: Florida.

In Florida, the biggest inventory increases initially over the past two years were concentrated in sections of Southwest Florida. Specifically, in markets like Cape Coral, Punta Gorda, and Fort Myers, which have been hard-hit by Hurricane Ian in September 2022. This mixture of elevated housing provide on the market—the broken houses developing on the market—coupled with strained demand—the results of spiked house costs, spiked mortgage charges, greater insurance coverage premiums, and better HOAs—translated into market softening across much of Southwest Florida.

Nonetheless, the stock will increase in Florida now expands far past SWFL. Markets like Jacksonville and Orlando are additionally above pre-pandemic ranges, as are many coastal pockets alongside Florida’s Atlantic Ocean facet.

One cause being that Florida’s condo market is coping with the after effects of regulation passed following the Surfside condo collapse in 2021. That is compounded by a slowdown in work-from-home migration to Florida and vital home insurance shocks.

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r=0;r<e.size;r++)if(e[r].contentWindow===a.supply){var i=a.knowledge["datawrapper-height"][t]+"px";e[r].fashion.peak=i}}}))}();

Again in August 2024, solely 4 states had returned to or surpassed pre-pandemic 2019 energetic stock ranges. By October 2024, that quantity grew to eight states. In December 2024, that quantity was 9 states: Arizona, Colorado, Florida, Idaho, Oklahoma, Tennessee, Texas, Utah, and Washington.

States prone to be part of that listing quickly embody Oregon (which surpassed pre-pandemic stock ranges in November, solely to slide again below in December), Alabama, Nebraska, Hawaii, and Georgia.

Click here to view an interactive of the chart beneath (finest considered on desktop).

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r=0;r<e.size;r++)if(e[r].contentWindow===a.supply){var i=a.knowledge["datawrapper-height"][t]+"px";e[r].fashion.peak=i}}}))}();

Why are Solar Belt and Mountain West markets seeing a quicker return to pre-pandemic stock ranges than many Midwest and Northeast markets?

One issue is that some pockets of the Solar Belt and Mountain West skilled even higher house worth development through the pandemic housing increase, which stretched costs too far past native incomes. As soon as pandemic-fueled migration slowed, and charges spiked, it turned a difficulty in locations like Colorado Springs and Austin.

Not like many Solar Belt housing markets, many Northeast and Midwest markets have decrease ranges of homebuilding. As new provide turns into obtainable in Southwest and Southeast markets, and builders use affordability changes like mortgage fee buydowns to maneuver it, it has created a cooling impact within the resale market. The Northeast and Midwest don’t have that very same degree of latest provide, so resale/current houses are just about the one sport on the town.

Large image: Over the previous few years we’ve noticed a softening throughout many housing markets as strained affordability tempers the fervor of a market that was unsustainably scorching through the pandemic housing increase. Whereas home prices are falling in some areas around the Gulf, most regional housing markets are nonetheless seeing optimistic year-over-year home price growth. The large query going ahead is whether or not energetic stock and months of provide will proceed to rise and trigger extra housing markets to see outright worth declines?