Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

U.S. existing-home gross sales totaled simply 4.06 million in 2024—the lowest annual level since 1995, in response to the Nationwide Affiliation of Realtors. That’s far under the 5.3 million in pre-pandemic 2019.

However right here’s the factor: As we speak’s housing market is much more constrained when you think about that the U.S. now has 76.3 million extra people and 33.2 million extra households than it did in 1995.

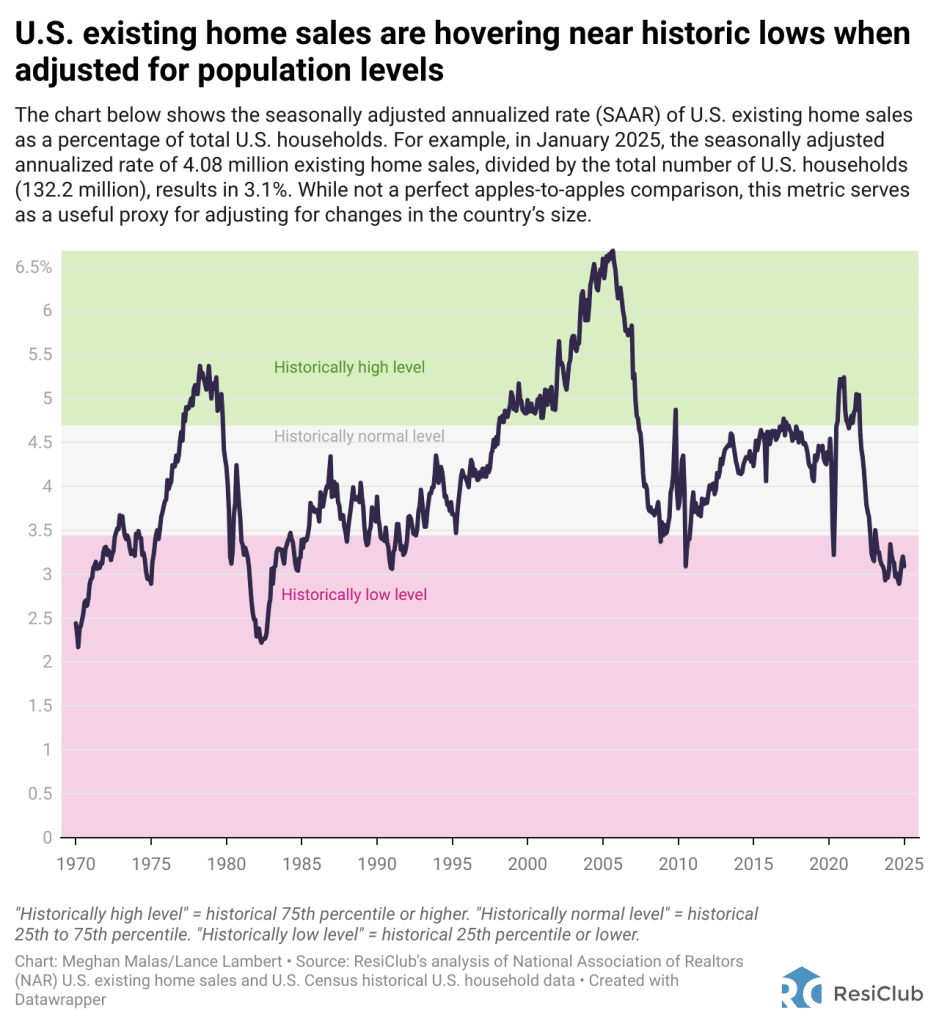

For example this level, ResiClub created the next chart: U.S. present house gross sales adjusted for inhabitants measurement. (We used whole family counts as a substitute of whole inhabitants counts).

In January 2025, the seasonally adjusted annualized charge of U.S. present house gross sales was 4.08 million. Dividing that determine by the full variety of U.S. households (132.2 million) ends in 3.1%.

Just about the final time U.S. present house gross sales—adjusted for inhabitants—had been decrease was within the early Eighties, when the average 30-year fixed mortgage rate peaked at 18.63% in October 1981.

The sharp deterioration in housing affordability has constrained present house gross sales throughout the nation. A few of this is because of homebuyers pulling again from the market, however a lot of it stems from householders who wish to promote and purchase one thing else however aren’t doing so. Giving up their decrease month-to-month cost and rate of interest—73.3% of excellent mortgages have a charge under 5.0%—for a a lot increased month-to-month cost and charge is tough to abdomen. And even when they had been prepared to maneuver, many householders can’t qualify proper now for that new mortgage at present mortgage charges and residential costs.

To check with the evaluation/chart above, under is the month-to-month seasonally adjusted annualized charge (SAAR) of U.S. present house gross sales with out adjusting for inhabitants.

Massive image: To a point, pent-up churn is build up within the housing market. In concept, the lock-in impact attributable to the affordability deterioration and mortgage charge shock is most acute proper out of the gate. Nonetheless, over time, as way of life modifications improve, incomes rise, and affordability improves, some extra turnover within the present house market could possibly be unlocked as “switching costs” come down.