Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Speaking to investors last week, Lennar co-CEO Jon Jaffe mentioned that the spring 2025 promoting season for America’s second-largest homebuilder is off to a slower-than-normal begin.

“We don’t see the seasonal pickup sometimes related to the start of the spring promoting season,” Jaffe mentioned. “So we proceed to lean into our machine specializing in changing leads and appointments and adjusting incentives as wanted to keep up gross sales tempo. These changes got here within the type of mortgage price buydowns, value reductions, and shutting value help.

Final quarter, Lennar spent the equal of 13% of dwelling gross sales on purchaser incentives—up from 1.5% in Q2 2022 on the peak of the pandemic housing growth. A 13% incentive on a $400,000 dwelling interprets to $52,000 price of incentives.

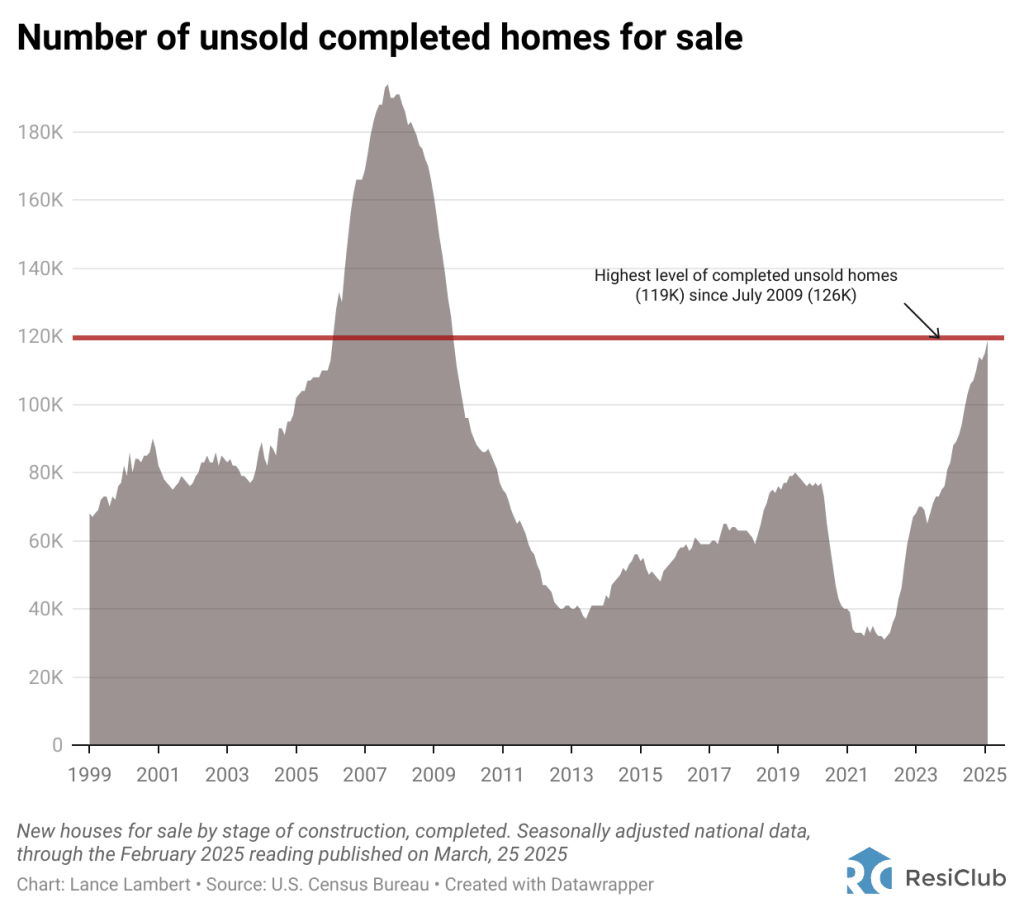

This weaker housing demand surroundings is inflicting unsold stock to tick up. Certainly, for the reason that pandemic housing growth fizzled out, the variety of unsold completed new single-family homes within the U.S. has been rising:

February 2018: 63,000

February 2019: 75,000

February 2020: 77,000

February 2021: 39,000

February 2022: 31,000

February 2023: 70,000

February 2024: 88,000

February 2025: 119,000

The February determine (119,000 unsold accomplished new properties) printed this week is the best stage since July 2009 (126,000).

Let’s take a better have a look at the info to raised perceive what this might imply.

To place the variety of unsold accomplished new single-family properties into historic context, we created a brand new index: ResiClub’s Completed Properties Provide Index.

The index is one easy calculation: The number of unsold completed new single-family homes in the U.S. divided by the annualized rate of U.S. single-family housing starts in the U.S.

A better index rating signifies a softer nationwide new development market with higher provide slack, whereas a decrease index rating signifies a tighter new development market with much less provide slack.

If you happen to have a look at unsold accomplished single-family new builds as a share of single-family housing begins (see chart beneath), it nonetheless reveals we’ve gained slack; nevertheless, it places us nearer to pre-pandemic 2019 ranges than the 2008 housing bust.

Whereas the U.S. Census Bureau doesn’t give us a higher market-by-market breakdown on these unsold new builds, now we have a good suggestion the place they’re primarily based on complete lively stock properties on the market (together with current properties) that spiked above pre-pandemic 2019 ranges. Most of these areas are within the Solar Belt across the Gulf.

“Some builders are dealing with pricing stress—particularly in key Florida and Texas markets, the place resale provide can also be effectively above pre-COVID norms,” Dillan Krieg, an analyst at John Burns Analysis and Consulting, not too long ago wrote on LinkedIn.

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r=0;r<e.size;r++)if(e[r].contentWindow===a.supply){var i=a.information["datawrapper-height"][t]+"px";e[r].model.peak=i}}}))}();

Massive image: There’s higher slack within the new development market now than a couple of years in the past, giving consumers some leverage in sure markets to barter higher offers with homebuilders.