The curious trade got here a bit of previous 9 p.m. on Jan. 17 — a $1,096,109 wager lower than two minutes after the soon-to-be president of the US posted on his social media account that his household had issued a cryptocurrency referred to as $Trump.

In these first minutes, a crypto pockets with a singular identification code starting 6QSc2Cx secured a large load of those new tokens — 5,971,750 of them — on the opening sale value of simply 18 cents every, beginning a surge within the $Trump value that will quickly attain $75 per token.

This early dealer, whose id will not be recognized, walked away with a two-day revenue of as a lot as $109 million, based on an evaluation carried out for The New York Occasions.

However the quick income for early merchants, whose names are unknown however a few of whom look like based in China, got here on the expense of a far bigger variety of slower buyers who’ve cumulatively suffered greater than $2 billion in losses after the worth of the token crashed.

As of the center of this week, greater than 810,000 wallets had misplaced cash on the wager, based on an examination that the crypto forensics agency Chainalysis carried out for The New York Occasions. The full losses are nearly actually a lot bigger: The information doesn’t embody transactions that befell on a collection of popular crypto marketplaces that began providing the coin solely after its value had already surged.

The value of $Trump hovered round $17 this week, lower than 1 / 4 of its $75 peak worth.

Whether or not individuals made or misplaced cash, it was stellar enterprise for the Trumps. Practically $100 million in buying and selling charges have flowed to the household and its companions, though most of that has not but been cashed out, the Chainalysis knowledge reveals.

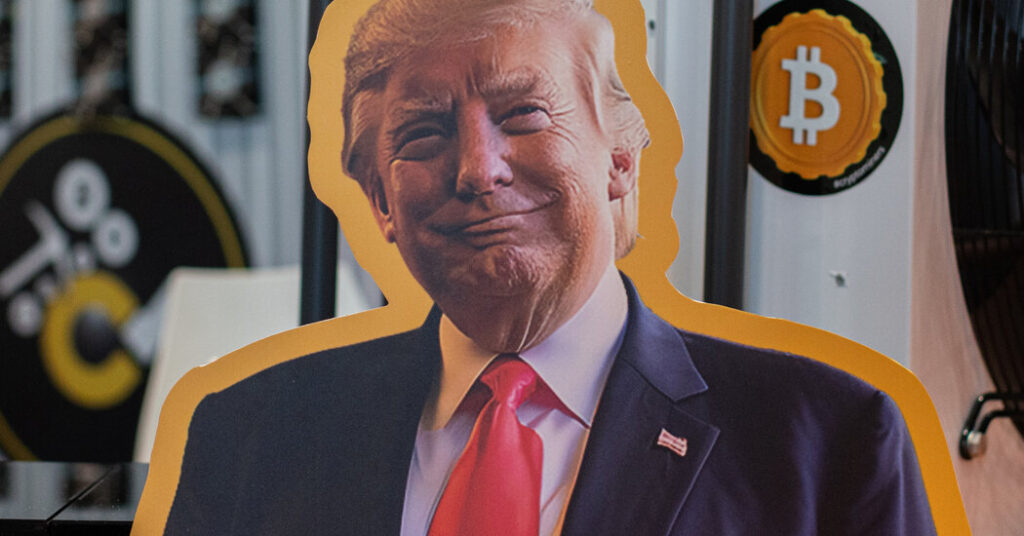

President Trump set off this scramble three days earlier than he was inaugurated, triggering a speedy boom-and-bust sequence that has now raised broader questions in regards to the speculative risks of so-called memecoins, a sort of cryptocurrency based mostly on an internet joke or movie star mascot.

He promoted the coin on his personal social media platform, in addition to Elon Musk’s X, saying: “Be a part of my very particular Trump Group. GET YOUR $TRUMP NOW.”

The chain of occasions is hardly shocking, a number of former state and federal monetary regulators stated.

It’s successfully part of the design of the whole memecoin business, which is authorized however largely unregulated. The buying and selling is constructed on giant early buys by subtle merchants who pump up the worth, solely to promote their holdings as much less skilled retail buyers observe their lead and purchase in, and infrequently find yourself with losses.

What makes this example notably troubling, to authorities watchdogs and former regulators, is that the Trump household is benefiting from this exploitative sample on the identical time that Mr. Trump is quickly shifting to carry an abrupt finish to a regulatory crackdown on crypto by a number of authorities businesses.

“The president is collaborating in shady crypto schemes that hurt buyers whereas on the identical time appointing monetary regulators who will roll again protections for victims and who could insulate him and his household from enforcement,” stated Corey Frayer, who not too long ago left a publish as a crypto adviser to the Securities and Alternate Fee.

The losses on the $Trump wager have been very actual for tons of of hundreds of buyers, together with some who’re vocal supporters of Mr. Trump.

Within the days earlier than Mr. Trump was sworn in, Shawn M. Whitson, 40, of Walnut Cove, N.C., proprietor of a small pc restore enterprise, had celebrated Mr. Trump’s return to the White Home. “At this time, we take our nation again!” Mr. Whitson wrote, with a photograph of Mr. Trump, on Inauguration Day. He additionally expressed hope that $Trump would rise in value.

However by the tip of January, Mr. Whitson was fed up. “Executed with this $Trump crap,” he wrote in a social media posting. Mr. Whitson, reached by The Occasions on Friday expressed disappointment. “That coin is a joke.”

Over the previous six months, President Trump and his sons have made a collection of aggressive forays into the crypto business. As Mr. Trump promoted crypto on the marketing campaign path, he additionally helped begin an organization referred to as World Liberty Monetary, which provided a digital foreign money referred to as $WLFI to sure rich buyers with expertise in monetary markets.

Final week, Trump Media & Expertise Group, the dad or mum firm of Mr. Trump’s social media platform, Reality Social, announced that it was shifting into the monetary companies business by making a model often known as TruthFi that can provide funding merchandise tied to Bitcoin.

Trump Media’s chief government, Devin Nunes, referred to as the choices “a aggressive various to the woke funds and debanking issues that you simply discover all through the market.”

However the debut of the $Trump memecoin was the primary time the Trump household had marketed a brand new crypto token on to unusual buyers.

On the request of The Occasions, crypto consultants reconstructed a number of the early trades made by patrons of Mr. Trump’s token, inspecting their revenue taking and the way, as soon as the preliminary patrons began to dump their holdings, the worth of $Trump then crashed, hurting different buyers.

The evaluation of crypto transaction information was executed by the forensic companies Nansen and Chainalysis in addition to by Molly White, an impartial crypto researcher who is usually essential of the business. The information was then reviewed by The Occasions.

This sample of huge, quick patrons coming into after which promoting out of their memecoin holdings is a part of the rationale that state regulators in New York recently warned consumers about these choices, saying that “creators or their associates artificially inflate the worth of the cash after which promote their very own cash quickly at an inflated value, reaping substantial income whereas inflicting the worth to crash.”

New York regulators referred to as these maneuvers “pump-and-dump schemes” and stated they’ll go away patrons who are available in late with large losses.

No proof has emerged that Mr. Trump or his associates artificially inflated the coin’s value or engaged in insider buying and selling. Requested in regards to the early $Trump trades and revenue taking, the president’s center son, Eric Trump, declined to remark.

The Beginning Gun

Within the crypto world, each transaction is recorded on a publicly viewable ledger often known as a blockchain. Sometimes, the names of the individuals making trades stay hidden, with every account recognized solely by a protracted chain of letters and numbers.

The blockchain permits crypto analysts to return and have a look at new choices and decipher what every pockets did — when it first invested, when it transferred any tokens or offered them off, and what the final word revenue and loss turned out to be for each play. This evaluation can even level to anomalies in trades that increase questions.

For instance, blockchain information present that the $Trump token was “minted” at 9:01 a.m. Japanese time on Jan. 17, making a so-called contract handle. It was not introduced by Mr. Trump for an additional 12 hours.

However the account behind the primary giant public buy — the $1,096,109 wager — was created about three hours earlier than Mr. Trump launched the coin, an evaluation of public crypto transaction information discovered. It had been filled that night with digital currencies, seemingly able to pounce on a brand new providing.

The well-timed trades, and the truth that the pockets obtained its funding shortly earlier than Mr. Trump’s coin launched, immediately drew skepticism from crypto analysts, who speculated {that a} dealer had been performing on inside data.

Within the crypto world, pinning down the particular person behind a commerce is usually unimaginable. It is not uncommon for individuals to publish large and typically unverifiable claims on social media earlier than abruptly disappearing, making it troublesome for novice buyers to differentiate professional investments from scams.

This month, an X account claiming to characterize a Dubai-based crypto dealer named Syed Sameer posted that he was the proprietor of one of many wallets that had orchestrated the primary big $Trump commerce value $1.1 million.

Mr. Sameer, who additionally claimed to be an investor in World Liberty Monetary, was subsequently accused on X of utilizing insider data to get in early on the $Trump token.

However the examination by The Occasions discovered inconsistencies within the claims on Mr. Sameer’s web site and X account. After he was confronted with these points, Mr. Sameer stated in messages on the chat app Telegram that he didn’t truly management the pockets.

Mr. Sameer had lied about it “for clout, to be trustworthy with you,” he stated. “I do know it’s silly and infantile however yeah, I used to be messing about.”

The Fortunate 31

What is obvious, based mostly on blockchain information, is that the particular person behind that $1.1 million commerce is a giant participant among the many hordes {of professional} merchants who quickly purchase up after which unload new memecoins, attempting to money in on speculative surges because the cash are issued.

After making the acquisition, the proprietor of the account then quickly moved to promote the cash, producing a revenue of no less than $50 million, based on the evaluation of the transaction by Aurelie Barthere of Nansen. Additional gross sales introduced the whole income to $109 million, based on the evaluation by Ms. White.

Different giant $Trump trades have additionally drawn consideration, together with one by a dealer who started buying the coin about two minutes after it was launched. The dealer then sold these $Trump tokens in lower than a half an hour, with a internet revenue of $2.7 million, the blockchain reveals.

Slightly below 700,000 wallets recorded features on $Trump, the examination by Chainalysis reveals. The early trades have been a number of the most worthwhile: 31 of those giant early merchants made $669 million in income in a matter of days, based on the Nansen evaluation.

However for each winner, there have been much more losers.

Throughout the primary 19 days of buying and selling, a complete of 813,294 wallets registered losses, both by cashing out at a loss or holding onto cash that had plummeted in worth.

The losers — those that paid extra for the token than it’s now value — cumulatively have misplaced $2 billion, in precise or paper losses. Nonetheless, many of those merchants are holding on to their money-losing tokens, maybe hopeful that the worth will rise once more, the info reveals.

The income principally secured by the early patrons have been monumental: a complete of $6.6 billion in cashed-out income, based on Chainalysis.

This can be a acquainted sample for crypto merchants. Just a few weeks earlier than the $Trump launch, a number of the identical wallets that purchased the president’s token also traded a memecoin referred to as Hawk Tuah, promoted by the social media influencer Haliey Welch.

The Hawk Tuah coin surged in December after it was first launched to a $490 million market capitalization, after which crashed to $10 million as of this week, leaving hundreds of buyers with losses and generating a lawsuit claiming it had “created a speculative frenzy” and violated federal regulation. (Ms. Welch said on X that she was “absolutely cooperating with and am dedicated to helping the authorized staff representing the people impacted.”)

“That is much like sports activities betting or playing,” stated Gareth Rhodes, a former deputy superintendent on the New York State Division of Monetary Companies, which helps regulate the crypto industry and different monetary companies firms. “The retail buyer placing of their funds is doing so vulnerable to dropping most if not all of it with the hope of an outsize payoff.”

Sheelagh McNeill contributed analysis.