Inflation unexpectedly slowed in March to its lowest charge since September, dropping to 2.4% 12 months over 12 months and over the past three months (February’s 2.8%, January’s 3%, and December’s 2.9%), in keeping with knowledge launched on Thursday by the U.S. Bureau of Labor Statistics.

The patron worth index (CPI), which tracks the costs of products and companies, fell by 0.1% in March on a month-over-month foundation. Core inflation, which measures will increase in costs of core items excluding meals and power, was 2.8% year-over-year in March, marking its slowest tempo since March 2021.

Associated: U.S. Businesses Added 155,000 New Jobs in March, According to ADP Data: ‘A Good One for the Economy’

“In a vacuum, that is the sort of inflation knowledge the Fed needs to see, with notable cooldowns in a number of the peskiest classes like housing and transportation companies,” Elyse Ausenbaugh, head of funding technique at J.P. Morgan Wealth Administration, advised Entrepreneur in an e mail.

Nonetheless, Ausenbaugh notes that slower inflation doesn’t suggest that the Federal Reserve will minimize charges on the subsequent Federal Open Market Committee assembly in Might. Whereas President Donald Trump has paused the elevated tariffs for a lot of nations for 90 days, there’s nonetheless a 10% tariff on all buying and selling companions, and an “at the least” 145% tariff on China that poses uncertainty for client costs.

“I anticipate them [the Federal Reserve] to remain humble and data-dependent,” Ausenbaugh acknowledged.

Associated: ‘Really Hard to Find a Job’: 1.7 Million Job Seekers Have Been Looking for Work for at Least 6 Months

EY Senior Economist Lydia Boussour advised Entrepreneur in an e mail that increased tariffs may result in increased inflation numbers down the highway. She predicted that core CPI inflation could be within the 3.5% to 4% vary by the top of the 12 months, a rise of at the least 0.7% from its degree in March.

“We imagine the Fed will ultimately resolve to ease coverage, however a late response to rising financial weak point will exacerbate the slowdown and favor three charge cuts within the second half of the 12 months because the financial system slows,” Boussour stated.

The CPI decline was led by a 6.3% month-to-month lower in costs for gasoline and a 4.2% drop in gasoline oil costs, which offset a 3.6% enhance in pure fuel costs, a 0.9% development in electrical energy prices, and a 0.4% rise in attire costs. Housing prices had been up 0.2%, whereas transportation was down 1.4%, each lower than February’s month-to-month adjustments.

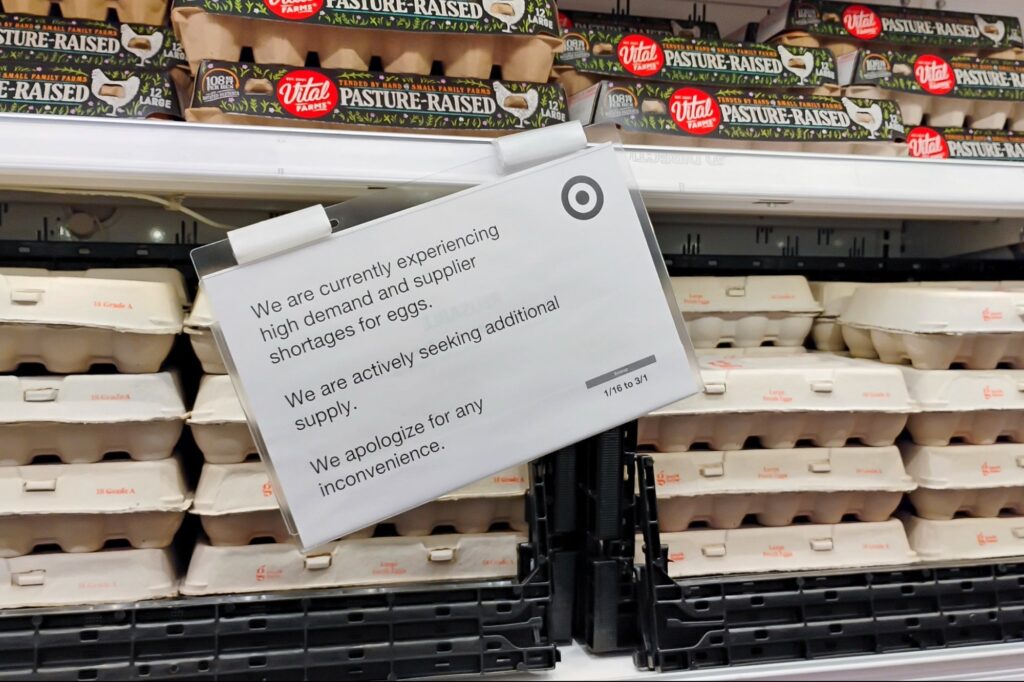

The meals class rose 0.4% month-over-month in March after a 0.2% rise in February. The worth of eggs, which went up by 5.9% from February to March, drove the majority of the rise, however the index for meats, poultry, fish, and eggs additionally rose by 1.3%.