Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

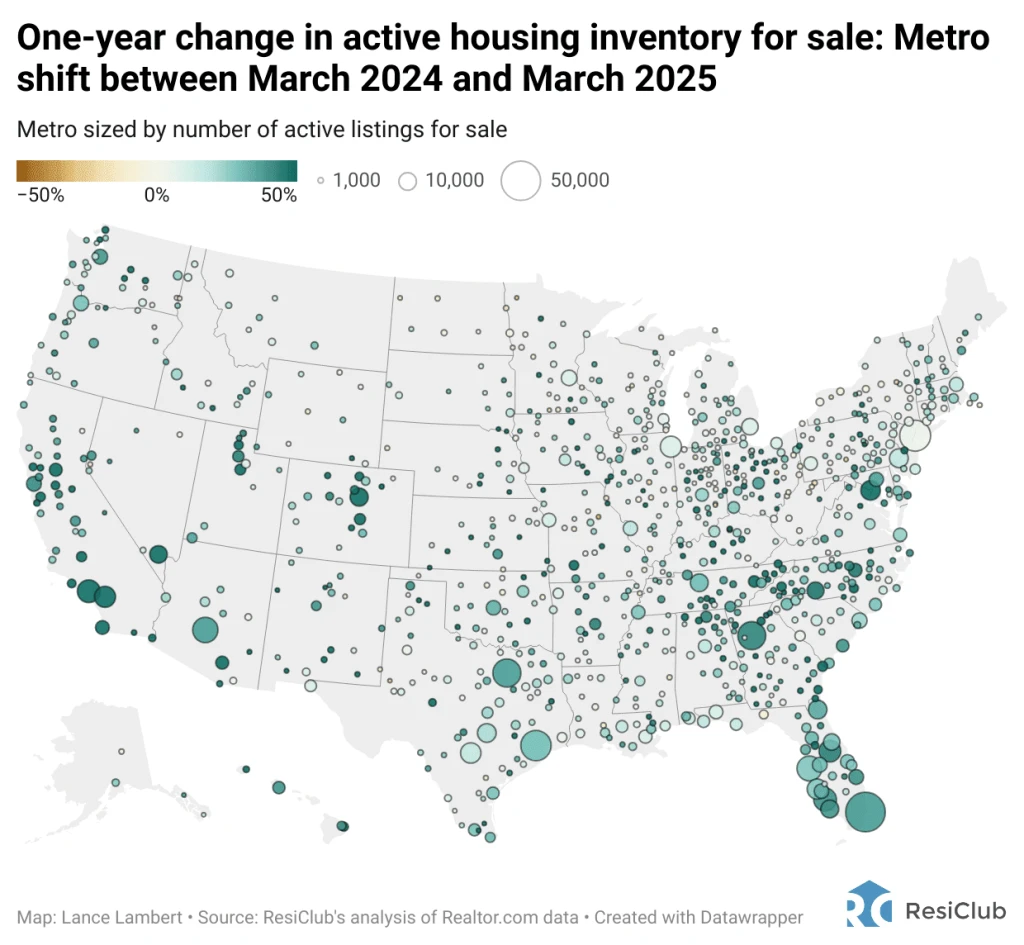

Whereas national active housing inventory for sale on the finish of March 2025 was nonetheless 20% under pre-pandemic March 2019 ranges, on a year-over-year foundation nationwide energetic listings are up 29% between March 2024 and March 2025. This means that homebuyers have gained some leverage in lots of components of the nation over the previous 12 months.

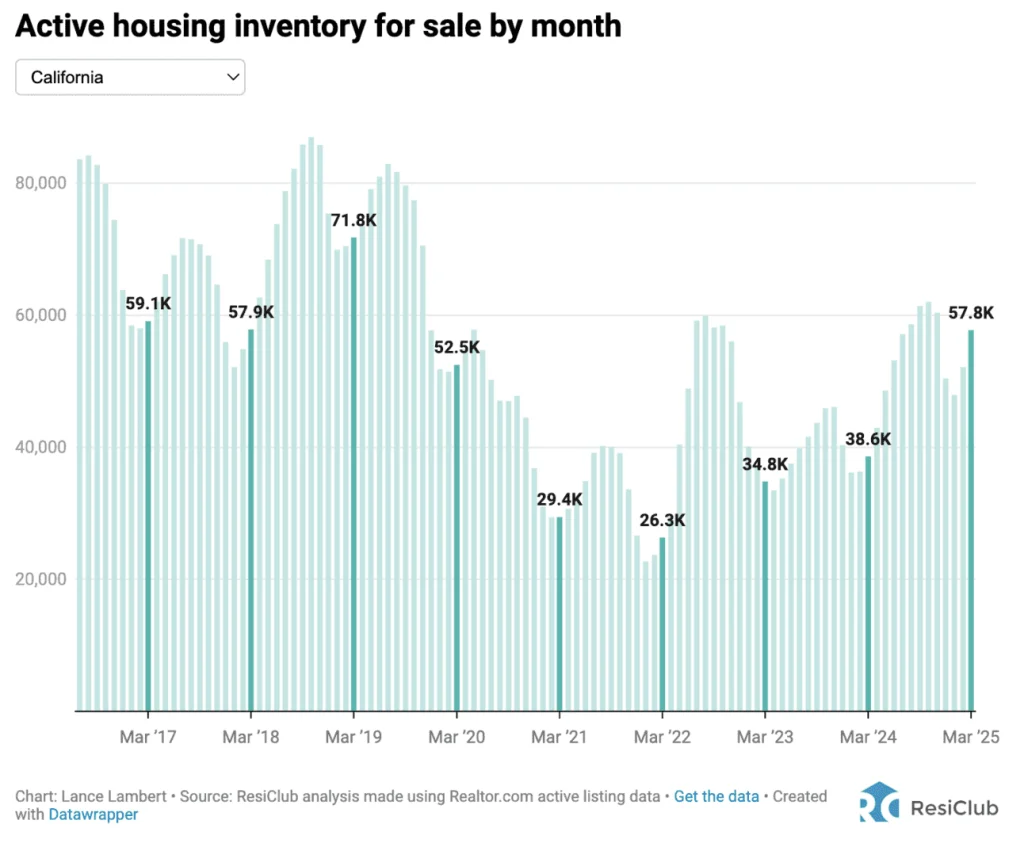

One of many biggest year-over-year increases is going on in California—the place energetic stock on the market is up 50% year-over-year.

Regardless of the 50% year-over-year leap in energetic California housing stock on the market—together with each single-family properties and condos—California on the finish of March 2025 nonetheless had 20% fewer properties on the market than it did in pre-pandemic March 2019.

However extra California housing markets are climbing out of that stock deficit. And if the present trajectory holds, California might quickly be out of its pandemic housing growth period stock gap.

Amongst California’s 36 main counties with no less than 100,000 residents, 9 have extra energetic housing stock on the market in March 2025 in comparison with pre-pandemic March 2019. The opposite 27 main California counties nonetheless have stock under pre-pandemic March 2019 ranges.

!operate(){“use strict”;window.addEventListener(“message”,(operate(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.model.peak=d}}}))}();

In housing markets the place energetic stock on the market rises considerably, homebuyers are gaining leverage. In housing markets the place energetic stock on the market has shot up above pre-pandemic 2019 ranges, homebuyers have gained appreciable leverage relative to previous years.

Homebuyers in San Francisco (specifically San Francisco correct’s condominium market) had much more leverage not too long ago than homebuyers in, say, Orange County.