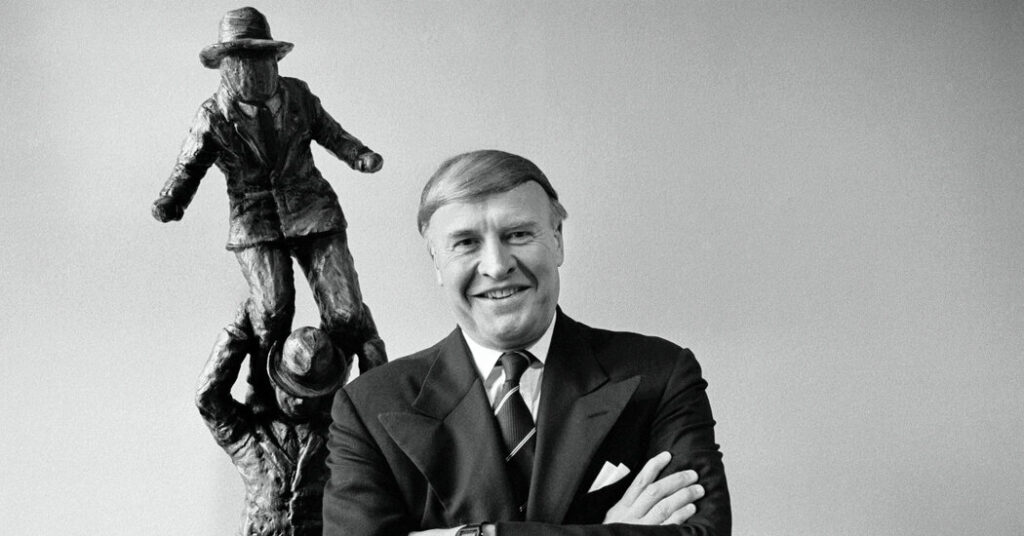

C. Richard Kramlich, an early investor in Silicon Valley who co-founded the funding big New Enterprise Associates, serving to to gasoline the booming tech business, died on Saturday at his dwelling in San Francisco. He was 89.

His loss of life was introduced by New Enterprise Associates.

Mr. Kramlich (pronounced CRAM-lick), whose profession spanned greater than 5 a long time, was among the many earliest backers of Apple Pc; the software program corporations Silicon Graphics and Macromedia; and the pc networking corporations Juniper Networks and 3Com, whose founders invented the Ethernet.

He co-founded his personal agency, New Enterprise Associates, or NEA, constructing it from an preliminary $16 million fund within the Nineteen Seventies to at least one that now oversees investments of practically $26 billion.

However he stood out amongst Silicon Valley’s sea of swashbuckling financiers due to his grace and kindness, mentioned Scott Sandell, the chief funding officer and govt chairman of NEA. “He believed the enterprise enterprise was a folks enterprise, and he acted accordingly,” he mentioned.

Charles Richard Kramlich was born on April 27, 1935, in Inexperienced Bay, Wis. His father, Irvin Kramlich, was a grocer who began a sequence of 25 meals shops that Kroger purchased in 1955; his mom, Dorothy (Earl) Kramlich, was an aeronautical engineer who later oversaw the family.

When he was 13, Dick adopted in his father’s entrepreneurial footsteps, beginning his personal “little lightbulb firm,” he mentioned in a 2015 interview with the Computer History Museum. “My father inspired me to do it if I used my very own cash, and so I purchased half a prepare automobile price of lightbulbs from Sylvania Company” and resold them from his bed room.

He added: “I come from three generations of entrepreneurs, and when you get it in your DNA, the whole lot else is boring.”

He attended Northwestern College, graduating with a bachelor’s diploma in Russian historical past in 1957, and went on to serve within the Strategic Air Command division of the Air Pressure. After receiving a grasp’s diploma from Harvard Enterprise Faculty, he went to work for Kroger, after which discovered the ropes of investing whereas working for a agency in Boston.

In 1969, he landed a coveted job at Arthur Rock & Co., one of many first funding corporations to make high-risk bets on unproven expertise start-ups. He beat out greater than a thousand different candidates, he mentioned within the 2015 interview, by sending Mr. Rock a handwritten letter expressing his need to search out “an even bigger life on the market.”

In 1977, he began NEA with Chuck Newhall and Frank Bonsal, two traders he had met in Boston. Persuading others to again their new fund took greater than a 12 months, and through that point Mr. Kramlich met a pair of entrepreneurs who had been each named Steve (Jobs and Wozniak).

Their firm, Apple Pc, was inferior to two different private pc corporations available in the market, Mr. Kramlich mentioned in 2015. However their sense of design and entrepreneurial spark had been spectacular. “They’d pizazz,” he mentioned, “the place the opposite two corporations had been extra engineering oriented.”

He felt compelled to take a position and used his personal cash to take action. The payoff got here three years later, in 1980, when Apple went public. That funding made it potential for Mr. Kramlich to purchase a 1927 Tudor home within the Presidio Heights neighborhood of San Francisco; he had bronze apples common because the entrance gate’s doorknobs to remind him of the windfall. (Final 12 months, he listed the home on the market for $19.5 million.)

Not lengthy after, he met Pamela Kay Palmer via a mutual buddy; they married in 1981.

Enterprise capital investing is designed to soak up many losses in pursuit of 1 home-run deal, leaving a graveyard of failed start-ups alongside the best way. However Mr. Kramlich was recognized for sticking with struggling investments lengthy after others had deserted them.

“He used to say, ‘By no means say die,’” Mr. Sandell mentioned.

Within the early Eighties, Forethought, the start-up behind PowerPoint software program, was about to expire of cash, and NEA’s companions refused to pony up extra. So Mr. Kramlich satisfied his spouse that they need to pause work on the home they had been constructing on Stinson Seaside and use the money to maintain the corporate alive as an alternative. The gamble paid off: In 1987, Microsoft bought Forethought for $14 million, and PowerPoint went on to turn into one of many world’s best-known software program packages.

Monetary Engines, an funding advisory start-up backed by NEA, took 18 years to go public and “went via 5 totally different enterprise fashions,” mentioned Jeff Maggioncalda, the corporate’s chief govt. NEA, he added, patiently held its shares the whole time.

Due to that persistence, and to Mr. Kramlich’s kindness, chief executives he had fired or threatened to fireside by no means stopped eager to work with him.

“Individuals don’t go away a relationship with Dick with any anger,” mentioned James Clark, a founding father of the pc software program and {hardware} firm Silicon Graphics, whose board of administrators Mr. Kramlich served on. “He’s only a basically good man.”

In 2002, Mr. Kramlich informed Mr. Maggioncalda that he could be pushed out by the tip of the 12 months if issues didn’t flip round. However Mr. Kramlich’s supply impressed belief fairly than worry, Mr. Maggioncalda recalled: “He mentioned it with a calmness and a supportiveness.” The corporate recovered, and Mr. Maggioncalda led it via an preliminary public providing in 2010.

After Mr. Kramlich retired from NEA in 2012, he continued to pursue a ardour for artwork accumulating. He and Ms. Kramlich had been among the many first personal collectors to concentrate on new media because it emerged as an artwork kind within the late Eighties, and so they amassed an in depth assortment that emphasised audio and pc artwork, video, movie and photographic slides. Their assortment of movies and installations grew to greater than 300 items — so giant that they constructed a three-level home in Napa Valley to show it.

Along with Ms. Kramlich, he’s survived by two youngsters, Christina and Richard Kramlich; a stepdaughter, Mary Donna Meredith; and 6 grandchildren. A son, Peter, died in 2024. Mr. Kramlich was married twice earlier than, to Deborah (Durbrow) Kramlich, whom he divorced in 1966, and to Lynne (Shamburger) Kramlich, who died in 1981.

In retirement, Mr. Kramlich continued to mentor founders and traders. He additionally began a brand new agency, Inexperienced Bay Ventures, with Anthony Schiller, a liquefied pure gasoline entrepreneur. The agency’s investments embody Databricks, the A.I. information firm; Dropbox, the file storage firm; and Xiaomi, the patron electronics firm.

Of their 12 years of working collectively, Mr. Schiller mentioned in a press release, he discovered quite a bit from Mr. Kramlich.

“There will likely be loads of well-deserved recognition for Dick’s legendary profession,” he mentioned. “However he was simply as extraordinary as an individual. He taught me about dreaming massive, loyalty, delight and alignment.”