Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Over the previous few years, we’ve skilled a historic deterioration in housing affordability.

The 51% surge in U.S. home prices since March 2020, mixed with mortgage charges rising from 3% to 7%, has resulted within the fastest-ever decline in housing affordability. By most measures, the early Nineteen Eighties housing market (when mortgage charges peaked at 18% in 1981) was barely extra unaffordable total. Nonetheless, by way of housing cycles, the tempo of change issues—which explains why homebuyers and trade professionals are feeling a bit dizzy.

Regardless of strained affordability, this 12 months marked the Thirteenth-consecutive calendar 12 months of rising nationwide dwelling costs, with many areas within the Midwest and Northeast experiencing elevated value progress. Nonetheless, in some Mountain West and Gulf markets, affordability pressures helped see dwelling costs plateau and even outright decline.

Heading into 2024, ResiClub expected important bifurcation within the housing market—a prediction that also holds for 2025.

Housing analyst Nick Gerli, founder and CEO of Reventure App—an actual property analytics platform that lets patrons and sellers forecast market traits—additionally anticipated regional bifurcation this 12 months. ResiClub not too long ago spoke with Gerli about his ideas on the 2025 housing market and whether or not he expects this development to proceed.

In the course of the pandemic housing increase, Florida’s housing market was among the many hottest within the nation. Nonetheless, the market has since cooled, with energetic stock now again above pre-pandemic ranges and falling dwelling costs in areas like Southwest Florida’s Punta Gorda and Cape Coral. Moreover, apartment costs are down 12 months over 12 months in practically each Florida market. What’s really driving this shift, and do you assume this development will proceed into 2025?

Florida is getting hit by three foremost headwinds coming into 2025: a structural slowdown in inbound migration, extra provide hitting the market from dwelling builders, and an affordability disaster for current householders associated to HOA and insurance coverage prices. The mixture of those elements is pushing extra stock onto the market and lowering purchaser demand.

Florida’s housing market will seemingly proceed to wrestle in 2025 attributable to these elements, and I wouldn’t be stunned if dwelling values in sure markets in Florida drop by as a lot as 10% subsequent 12 months. Cities reminiscent of Tampa, St. Petersburg, Sarasota, Punta Gorda, and Naples are most within the crosshairs of this slowdown.

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r=0;r<e.size;r++)if(e[r].contentWindow===a.supply){var i=a.knowledge["datawrapper-height"][t]+"px";e[r].fashion.peak=i}}}))}();

Let’s flip to Texas. Housing markets like Austin and San Antonio have been experiencing falling dwelling costs, and even Dallas has cooled considerably. What are the important thing elements contributing to this current weak spot in Texas, and do you see any indicators of stabilization or additional declines forward?

Texas’s housing market was at all times very inexpensive, and considerably undervalued earlier than the pandemic. Nonetheless, from 2020 to 2022, dwelling values spiked a lot that many native patrons in Texas may not afford to take part available in the market. The outcome was a slowdown in dwelling gross sales. On the similar time, dwelling builders permitted a large pipeline of latest houses and residences, which began to hit the market in 2024 and can proceed in 2025. The result’s larger stock and declining costs.

I believe Austin would be the first market to backside. Costs there are already down 20% from the height, and in keeping with Reventure App’s knowledge, they’re now solely 12% overvalued. Dallas is a market which may take longer to appropriate. Costs there are nonetheless very excessive in comparison with long-term norms, they usually’ve solely dropped a few proportion factors so far, indicating a big affordability hole available in the market.

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r=0;r<e.size;r++)if(e[r].contentWindow===a.supply){var i=a.knowledge["datawrapper-height"][t]+"px";e[r].fashion.peak=i}}}))}();

In distinction to Florida and Texas, the Midwest and Northeast housing markets have proven exceptional resilience. Energetic stock stays effectively beneath pre-pandemic ranges, and residential costs are nonetheless rising. In Buffalo, New York; Hartford, Connecticut; and Milwaukee, costs are even rising at elevated charges. What elements are supporting this resilience, and do you assume these areas can preserve their upward momentum?

The true tailwind behind Midwest and Northeast markets is affordability. Residence values in Buffalo, Hartford, and Milwaukee are nonetheless low cost sufficient in relative phrases for native patrons to afford the costs and mortgage funds. On the similar time, there may be little or no dwelling constructing in these areas, which suppresses new listings and provide. Reventure App is forecasting continued value progress in 2025 for these areas.

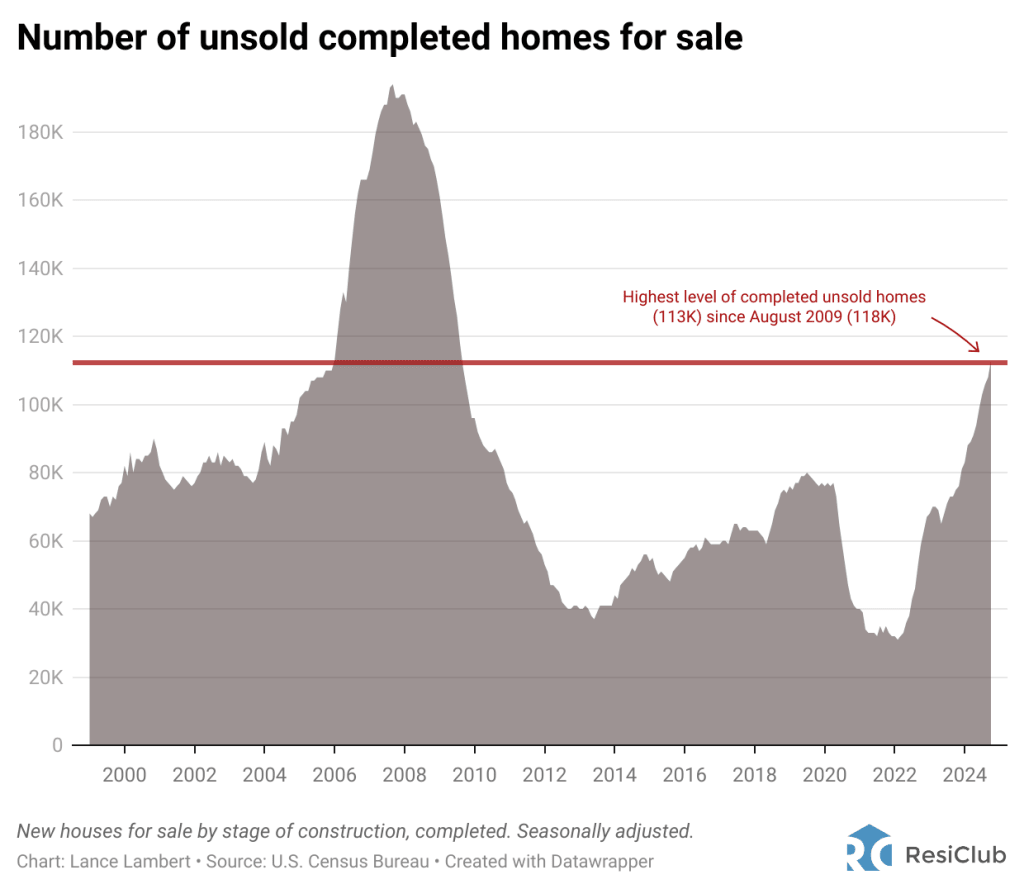

In October, U.S. homebuilders reported having 113,000 unsold new houses. Whereas that is nonetheless beneath the 2007 peak of 117,000, it’s above the pre-pandemic October 2019 stage of 77,000, and marks the very best stage since 2009. Does this sign that some builders might have to implement reductions to take care of gross sales momentum in spring 2025? How would possibly this have an effect on the broader housing market?

Builders are beginning to get a bit determined to maneuver their stock, notably down right here in Florida. I simply toured a house builder web site east of Tampa the place the builder provided me a 4.7% mortgage price for a 30-year time period, with the home priced at $150 [per square foot], which is a fairly whole lot. Builders are getting this aggressive in Florida and different components of [the U.S.] as a result of they’ve a pileup of unsold stock sitting on their heaps. As you identified, accomplished unsold spec stock is on the highest stage since 2009 nationally. And in states like Florida and Texas, the unsold stock is even larger.

Looking forward to 2025, what’s your total outlook for the U.S. housing market? Are there particular areas of uncertainty or potential headwinds that patrons, sellers, and buyers ought to be paying shut consideration to?

On a nationwide stage, we anticipate dwelling costs to stay flat in 2025, with costs declining within the Southeast, Texas, and Mountain states. Values are anticipated to proceed to extend within the Northeast and Midwest, however by lower than they did in 2024. One macro-level development we’re monitoring with giant uncertainty is mortgage defaults and foreclosures. There was a rise in early-stage mortgage delinquencies in 2024, particularly amongst FHA and VA debtors. Many of those delinquencies are at the moment blocked from foreclosures by pandemic-era applications like loss mitigation and forbearance.

Will the incoming presidential administration take away these foreclosures protections and return the federal government mortgage market to pre-pandemic norms? In that case, there may very well be a rise in distressed promoting within the housing market in 2025 and better stock. On the demand facet, we anticipate a average bounce in existing-home gross sales 10% above their ranges in 2024. This will likely be attributable to rising wages and falling costs in some markets, thereby enhancing affordability.