When Elon Musk bought X for $44 billion in 2022, greater than 1 / 4 of that was financed by loans from banks together with Morgan Stanley. Banks usually rapidly dump such loans, however on this case they saved a lot of that debt as a result of traders had been reluctant to wager on the social media firm’s floundering enterprise.

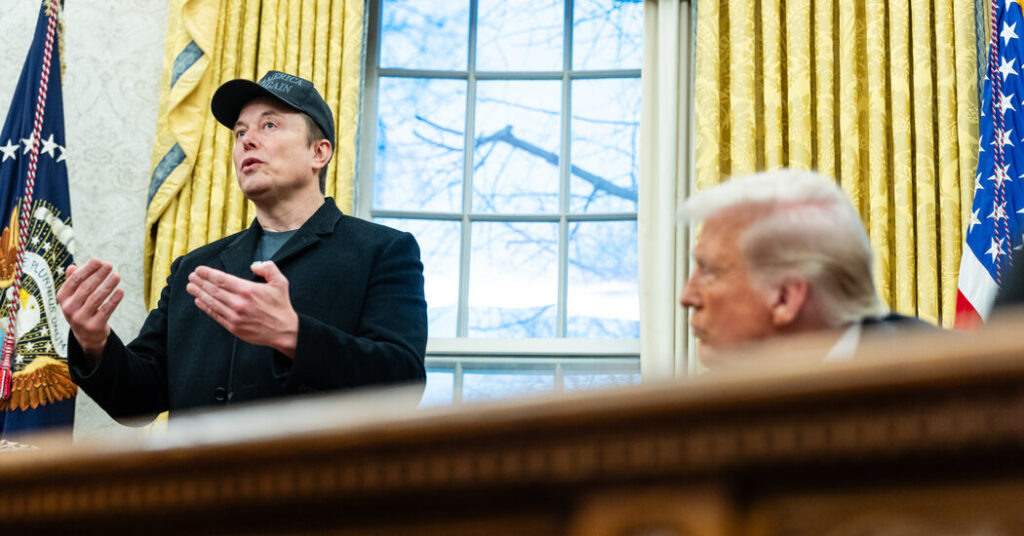

Mr. Musk’s newfound energy in President Trump’s administration has helped change traders’ minds.

On Thursday, the banks offered roughly $4.7 billion of X’s debt, in line with two folks acquainted with the transaction, greater than the $3 billion that they’d initially supposed to promote.

Mr. Musk, who has change into an in depth adviser to the president and is working a authorities effectivity initiative, has confronted growing questions on whether or not the businesses he leads — together with the electrical automaker Tesla and the rocket firm SpaceX — are benefiting from his position as Mr. Trump’s right-hand man.

X has change into a go-to platform for data on the administration’s plans, which Mr. Musk broadcasts to his account’s more than 217 million followers. Advertisers have returned in droves to X, folks acquainted with the offers stated, fueling a lift in income. The corporate informed traders that its income in December jumped 21 p.c from a month earlier, an individual with information of the funds stated.

An X spokesman and Morgan Stanley declined to remark. Bloomberg beforehand reported the jump in revenue and details of the transaction.

Promoting the debt — which totaled $12.5 billion on the time of the acquisition — helps Mr. Musk and the banks, which have been saddled with it for 2 years. Simply two months in the past, traders had been negotiating to purchase that debt at a lack of 10 p.c to twenty p.c for the banks, one individual concerned within the discussions stated.

However investor urge for food has shifted drastically. Final week, the banks offered $5.5 billion of the debt to a small group of traders, the folks acquainted with the transaction stated. This month, Diameter Capital Companions purchased $1 billion of the debt. The banks have now offered practically all of their X debt, leaving roughly $1 billion on their steadiness sheets.

Buyers had been motivated to purchase X’s debt due to a number of components, together with the corporate’s bettering income. Advertisers like Amazon and Apple have returned after fleeing over controversial actions by Mr. Musk, three of the folks concerned within the discussions stated.

X’s income rose 40 p.c final yr after a dismal 2023, the individual acquainted with the corporate’s funds stated. Extra subscribers are paying for X’s premium service, and Mr. Musk’s synthetic intelligence enterprise, xAI, pays X to license its information, the folks acquainted with X’s enterprise stated.

“Extra enterprise appears to be coming in than it has within the final two years,” Brett Weitz, X’s head of content material, wrote in an inside e mail in January, which was seen by The New York Occasions.

Going into the Tremendous Bowl final Sunday, the corporate was set to earn $7.9 million in associated promoting income, barely outperforming its $7.2 million from the occasion in 2024, in line with an inside doc seen by The Occasions.

The corporate’s intensive cost-cutting measures, together with decreasing workers by greater than 80 p.c, have additionally appealed to traders, the folks stated.

X’s fortunes — each financially and politically — have improved as Mr. Musk has aligned himself with Mr. Trump, three folks acquainted with the transaction stated.

And whereas the folks acquainted with the deal stated traders didn’t count on to curry favor with Mr. Musk by lending him cash, they noticed the way forward for his corporations as brighter now that he was on the coronary heart of the federal government. Additionally they stated they believed Mr. Musk’s new function meant the cash was extra more likely to be paid again.

Some advertisers that returned to X not too long ago had been frightened concerning the repercussions from advocacy teams in the event that they supported the corporate, stated three advert trade executives who weren’t licensed to talk publicly concerning the matter. Others had been involved about potential retribution from Mr. Musk if they didn’t return.

Final yr, Mr. Musk sued a number of massive manufacturers and the International Alliance for Accountable Media, a nonprofit coalition of main advertisers led by the World Federation of Advertisers, claiming the group had orchestrated a boycott towards X. GARM shut down days after the swimsuit was filed, however Mr. Musk has continued to press his case towards advertisers. This month, his legal professionals added a number of corporations to the case, together with Lego, Nestlé and Shell.

Mr. Musk’s ties to the White Home may assist his different companies. Weeks after Mr. Trump was elected, executives at Palantir despatched a memo to engineers, asking that they completely use Grok, an A.I. chatbot designed by Mr. Musk’s xAI, two Palantir workers stated. It was the primary time the corporate had requested them to make use of Grok over different chatbots.

A spokeswoman for Palantir declined to remark.

Ryan Mac and Sheera Frenkel contributed reporting.