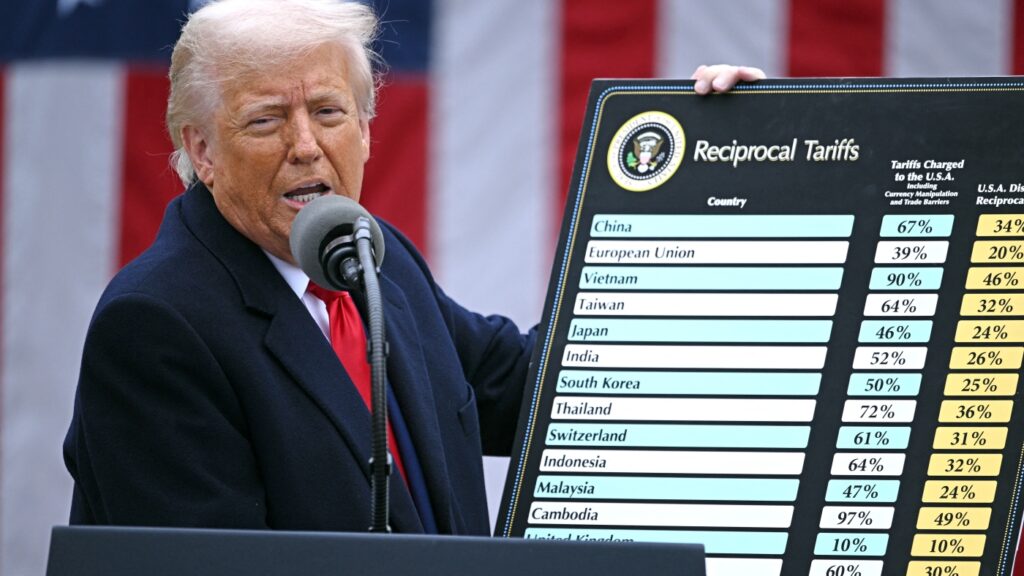

US President Donald Trump holds a chart as he delivers remarks on reciprocal tariffs throughout an occasion within the Rose Backyard entitled “Make America Rich Once more” on the White Home in Washington, DC, on April 2, 2025.

BRENDAN SMIALOWSKI/AFP through Getty Photos/AFP

conceal caption

toggle caption

BRENDAN SMIALOWSKI/AFP through Getty Photos/AFP

That is an excerpt of the Planet Cash publication. You can sign up here.

Amid the dizzying commerce actions President Trump has taken in current days, it was simple to overlook a outstanding speech the White Home launched by considered one of Trump’s high financial advisors, Stephen Miran. In that speech, Miran hinted that the White Home is likely to be working to ascertain a brand new form of international financial order that goes past simply increased tariffs.

Because the White Home has already made fairly clear, its financial objectives embrace lowering or eliminating America’s commerce deficits with international nations and boosting home manufacturing. Tariffs are one large device for these objectives. However the current international financial system is constructed on extra than simply low tariffs and free commerce. It is constructed on a particular function that the U.S. greenback performs within the international economic system. The greenback is the “worldwide reserve forex.” It is the principle forex the world makes use of to commerce and save.

This particular function for the greenback may be traced again to 1944. That is when international monetary leaders met at a flowery lodge in Bretton Woods, New Hampshire, and hammered out the main points of a brand new international financial order that will take maintain after World Warfare II ended. (For extra on the fascinating historical past of this, learn this old Planet Money newsletter and hearken to this Planet Money episode).

On this current speech and former writings, Miran has complained that — whereas this particular standing for the greenback offers advantages to the US and the worldwide economic system — it additionally strengthens the greenback, making American exports dearer and U.S. manufacturing much less aggressive. He has urged that America principally wants one other Bretton Woods-style assembly to reform the worldwide financial system, which would come with probably serving to the US to devalue the greenback or getting the world to compensate the US for the particular function the greenback performs in it. He has dubbed this potential summit the “The Mar-A-Lago Accord.”

Some observers, including Stanford historian Jennifer Burns, consider this concept is definitely a main motivation for Trump’s aggressive tariff coverage. That the White Home desires to strengthen their fingers in negotiations for a grand discount that serves America’s economic system.

Is the particular international function for the greenback a privilege or burden?

The reserve forex standing of the greenback gives many advantages to the US. One large one is it offers the US a monetary weapon to sanction different nations, by, for instance, slicing their banks off to the stream of {dollars} or seizing U.S. monetary belongings, like the U.S. did to Russia after it invaded Ukraine. As a result of the greenback is the worldwide reserve forex, it is the lifeblood of commerce all over the world — even commerce that does not contain the US. Management over the greenback offers the U.S. authorities a superpower over the worldwide financial system.

One other large good thing about this particular function for the greenback is decrease rates of interest on U.S. debt. Folks all over the world have actually wished {dollars} and dollar-backed belongings like U.S. Treasury bonds, which is how the federal government points debt. Once we purchase stuff from overseas, these nations get {dollars}, and they should do one thing with them. Lots of the time they purchase U.S. debt. This mighty international demand for U.S. debt lowers rates of interest on it. It is like the US has a particular, low-interest bank card and might spend like loopy and never face the identical monetary penalties as different nations. Economists have referred to as this and different advantages the U.S. will get from this method “the exorbitant privilege.”

However in his speech this week, Miran painted the greenback’s reserve forex standing as a form of exorbitant burden. “Whereas it’s true that demand for {dollars} has saved our borrowing charges low, it has additionally saved forex markets distorted,” Miran stated. Specifically, with a lot international demand for U.S. {dollars}, the worth of the greenback is increased than it could in any other case be. That is nice if you happen to’re an American client as a result of international imports are comparatively cheaper with a stronger greenback, however that is much less nice if you happen to’re an American exporter. A stronger greenback implies that American exports are dearer to foreigners.

There’s one other kind of bizarre quirk about having the greenback as the worldwide reserve forex. In what’s generally known as “the flight to security,” throughout occasions of financial stress, there’s been a bent for international traders to flee dangerous belongings like shares and purchase “safer” U.S. Treasury bonds. Economists debate whether or not that is an excellent or unhealthy factor, nevertheless it implies that the greenback tends to strengthen much more throughout recessions. That is not nice for American exporters, together with producers, throughout onerous financial occasions. (Importantly — and this apparently really scared the White House — throughout this week’s financial turmoil there was no flight to safety. In reality, there was a flight away from U.S. monetary belongings. Rates of interest on U.S. debt spiked — and other people started worrying a few potential monetary disaster).

Miran stated in his current speech, the “reserve perform of the greenback has precipitated persistent forex distortions and contributed, together with different nations’ unfair boundaries to commerce, to unsustainable commerce deficits. These commerce deficits have decimated our manufacturing sector and lots of working-class households and their communities, to facilitate non-People buying and selling with one another.”

As we’ve covered before in the Planet Money newsletter, Vice President JD Vance has additionally questioned whether or not the reserve forex standing of the greenback is a privilege or a burden. Final yr, when he was a Senator, JD Vance highlighted that the reserve forex standing strengthens the worth of the greenback. That could be good for American shoppers, who get advantages like cheaper international items and worldwide journey. “But it surely does come at a price to American producers,” Vance stated. “I feel in some methods you’ll be able to argue that the reserve forex standing is a large subsidy to American shoppers however a large tax on American producers.” This, he urged, contributes to “our mass consumption of largely ineffective imports, on the one hand, and our hollowed-out industrial base then again.”

We spoke with UC Berkeley economist Barry Eichengreen, a number one scholar of worldwide finance and the writer of books like Exorbitant Privilege: The Rise and Fall of the Greenback and the Way forward for the Worldwide Financial System. And we requested him for his perspective on Miran and Vance’s arguments in regards to the prices of the greenback’s particular function on the earth.

“There’s a technical financial time period for these arguments: Nonsense,” Eichengreen says.

Sure, Eichengreen says, the greenback is barely stronger due to its central function it performs in worldwide commerce. “ However that is like issue quantity 17 on the listing of determinants of U.S. export competitiveness.” There are simply so many extra vital components figuring out whether or not American manufacturing is aggressive, just like the productiveness and wages of U.S. staff, the innovativeness of companies, the inflation price, the standard of our machines and tools, and on and on. The upper worth of the greenback because of excessive worldwide demand to carry it within the current system “is simply means down there within the components hollowing out — or not hollowing out — our manufacturing sector.”

Eichengreen says that the particular function for the greenback on the worldwide stage is “a big profit for America.” Positive, he says, economists debate in regards to the dimension of this profit. “ However I feel there’s a broad-based consensus that America is best off having the greenback taking part in this distinctive function.”

To be clear, President Trump himself has stated that the greenback’s reserve standing is actually vital. A month earlier than profitable reelection, Trump stated in an interview that if the greenback stopped being the reserve forex, America would go to “third-world standing.” He continued, “We can not lose it.” If any nation tried to desert it, he stated he’d inform them, “You are going to pay a 100% tariff on the whole lot you promote into the US” and drive them to desert these plans.

After taking workplace, Trump threatened a bunch of nations generally known as the “BRICS” group — together with Brazil, Russia, India, Iran, China, and South Africa (therefore, the acronym) — which has been working to develop another reserve forex to the greenback.

“We’re going to require a dedication from these seemingly hostile nations that they are going to neither create a brand new BRICS forex, nor again every other forex to switch the mighty U.S. greenback or, they are going to face 100% Tariffs,” President Trump stated on Fact Social in late January. “There is no such thing as a likelihood that BRICS will exchange the U.S. greenback in worldwide commerce, or wherever else, and any nation that tries ought to say hey to tariffs, and goodbye to America!” he added.

However, as Miran and Vance have highlighted, having the greenback as a global reserve forex additionally comes with tradeoffs, together with probably a stronger greenback. And Miran and different Trump officers are making a giant deal out of the downsides of that tradeoff. How can they’ve their cake and eat it too?

“The Mar-A-Lago Accord”

Miran has offered a possible roadmap to keep up the greenback as a global reserve forex whereas trying to cut back the prices to America for it. And a few observers, together with Jennifer Burns, consider this plan may assist clarify why Trump has been so aggressive in elevating tariffs on nations all over the world.

A couple of month earlier than President Trump chosen Miran to steer his Council of Financial Advisors, Miran printed a long essay outlining a collection of potential reforms.

One in all his large concepts was what he referred to as a “Mar-A-Lago Accord.” The essential concept is to get a bunch of representatives collectively — like the US did in Bretton Woods again in 1944 — and rewrite the phrases of the worldwide financial system. With this assembly, the US might get concessions, like serving to the US to devalue the greenback to enhance manufacturing competitiveness and lowering America’s debt burden.

In his speech this week, Miran argued that the US is principally underwriting the worldwide economic system with their use of the greenback and likewise international safety with safety from its army. He stated it is time for the world to share in paying for what he views as a big burden.

Miran supplied varied concepts for nations to pay the US for these international “public items” it supplies. They will, as an illustration, “settle for tariffs on their exports to the US with out retaliation.” They might purchase extra from America or spend money on factories right here. They might even “merely write checks to [the U.S.] Treasury that assist us finance international public items.”

It’s unclear that that is all of the precise technique behind Trump’s sprawling tariffs. Some consider there is not any coherent technique in any respect. The Trump administration has been throwing the kitchen sink of their arguments justifying their commerce actions and totally different advisors have been saying various things. The rollout of the tariffs has been erratic. U.S. monetary markets — together with the marketplace for U.S. authorities bonds — have been freaking out about all of this.

“ I hope that the occasions of the previous few days have reminded everyone within the administration that monetary markets have a low tolerance for these form of concepts extra broadly and for erratic adjustments in coverage,” Eichengreen says.

Regardless of this turmoil and antagonistic international diplomacy, there is a stickiness to the U.S. greenback because the worldwide reserve forex. Students — together with Eichengreen — have been warning that the greenback’s particular standing is at risk for many years. However the world retains utilizing it. There are super advantages to utilizing the greenback as a result of everybody else is utilizing {dollars}. And there is not a ready-to-go various.

Plus, Eichengreen says, the U.S. has — till now — been “an excellent steward” of the greenback and the function it performs within the worldwide financial system. The world has had religion in American establishments. It is a large motive for the “flight to security.” However that did not occur throughout this week’s self-imposed monetary turmoil. There was an epic inventory market downturn, and traders did not flock to Treasuries and different U.S. monetary belongings.

Eichengreen says that rates of interest on the bond market have moved for all kinds of potential causes, together with the potential of upper inflation due to the tariffs. He is cautious about studying short-term value actions as telling us one thing large about the way forward for the greenback. However, he says, he’s positively extra nervous lately.

“I am very rather more involved rapidly than I’ve been prior to now,” Eichengreen says. “We now have not seen in our lifetimes an effort to explode the worldwide financial order as we all know it. So now we’re in a world the place something that we used to take without any consideration — and that actually contains the worldwide function of the greenback — is out of the blue unsure.”