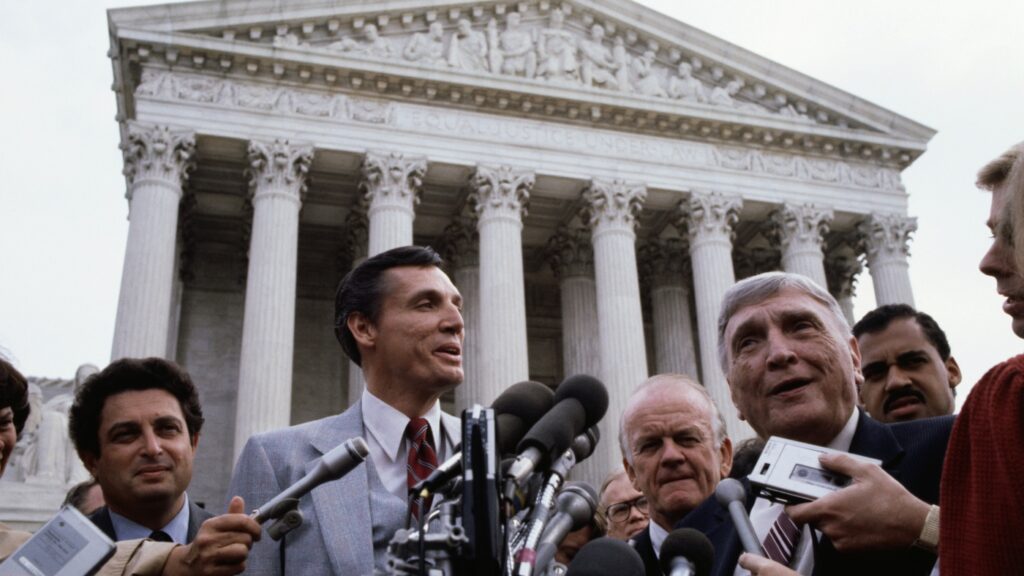

Bob Jones III, the president of Bob Jones College, speaks outdoors the U.S. Supreme Court docket in 1982. The IRS rescinded the college’s tax-exempt standing within the 1976.

Bettmann Archive/through Getty Pictures

disguise caption

toggle caption

Bettmann Archive/through Getty Pictures

In an escalating combat over federal funding, President Trump has threatened to revoke Harvard College’s tax-exempt standing.

“Keep in mind, Tax Exempt Standing is completely contingent on performing within the PUBLIC INTEREST!” Trump wrote in a publish on Truth Social this week. He urged Harvard must be “Taxed as a Political Entity if it retains pushing political, ideological, and terrorist impressed/supporting ‘Illness.'”

On Thursday, Trump advised reporters administration officers had been weighing subsequent steps and mentioned, “I do not suppose they’ve made a remaining ruling.” The IRS did not reply to NPR’s request for remark. The White Home, earlier within the week, hadn’t responded for remark both.

The federal authorities has long exempted universities from taxes due to their “educational purposes” and dedication to public service. Trump’s menace might result in a shocking retaliation towards Harvard for its refusal to comply with the administration’s current calls for – however it’s not fully unprecedented.

A minimum of one college is understood to have had its tax-exempt standing rescinded: Bob Jones College in South Carolina. The eventual 1983 Supreme Court docket ruling in that case would seemingly function the authorized precedent for the Trump administration in a case towards Harvard, says Michael Graetz, a professor of tax legislation at Yale College.

“Since 1913, the fashionable revenue tax has been in place and Harvard has been tax exempt for all of that point,” he says. “And nobody has severely questioned [their] tax exemption till now.”

Graetz wrote the ebook The Energy to Destroy: How the Antitax Motion Hijacked America. He says, if Trump follows by means of on his menace and succeeds, “the monetary impression to Harvard could be very, very massive.”

Not solely would Harvard lose the flexibility to earn income on its $53.2 billion endowment, however Graetz says Harvard donors would lose the flexibility to jot down off donations after they file their taxes.

Harvard spokesperson Jason Newton mentioned in an electronic mail to NPR, “There isn’t any authorized foundation to rescind Harvard’s tax-exempt standing.” Such an motion, he mentioned, would hamper Harvard’s instructional mission severely and would “end in diminished monetary support for college kids, abandonment of vital medical analysis packages, and misplaced alternatives for innovation.”

Trump’s menace comes because the administration continues to argue that a number of larger schooling establishments, together with Harvard, aren’t doing sufficient to guard their Jewish college students from discrimination. On April 11, the administration despatched Harvard its latest list of demands, emphasizing considerations round antisemitism on campus. It ordered Harvard to alter its hiring, admissions and different insurance policies, and to get rid of variety, fairness and inclusion (DEI) packages.

In response, Harvard said it has already taken substantial steps towards preventing antisemitism, and the administration’s calls for go “past the facility of the federal authorities.”

After Harvard refused to comply, the administration’s Joint Job Power to Fight Anti-Semitism announced a freeze on greater than $2.2 billion in federal funding for the varsity. The U.S. Division of Homeland Safety has additionally been pressuring Harvard to show over the disciplinary data of worldwide college students, together with those that’ve participated in campus protests. NPR obtained a letter the company despatched this week saying Harvard’s eligibility to host worldwide college students shall be revoked if it would not submit the data by April 30.

What occurred to Bob Jones College

For a few years, Bob Jones College, a non-public Christian faculty in Greenville, S.C., had a coverage in place that forbade its college students from interracial courting or marriage. In 1976, the IRS discovered the varsity was participating in illegal racial discrimination and revoked Bob Jones College’s tax-exempt standing.

The school sued the federal authorities and the case made all of it the best way to the Supreme Court docket. In query was whether or not Bob Jones’ discriminatory coverage was protected by its proper to spiritual freedom, as a result of the varsity claimed the Bible prohibited race-mixing.

In 1983, the Supreme Court docket dominated in favor of the IRS, in an 8-1 decision, saying racial discrimination in education violated “basic nationwide public coverage” and “not all burdens on faith are unconstitutional.”

Larry Zelenak, a professor of legislation at Duke College, says he believes the Trump administration might lean on the Bob Jones ruling if it had been to proceed with revoking Harvard’s tax-exempt standing, arguing that Harvard discriminates towards Jewish college students by failing to guard them from antisemitism on campus.

Folks cross Harvard Yard on Harvard College’s campus in Cambridge, Mass., on Thursday.

Sophie Park/Getty pictures

disguise caption

toggle caption

Sophie Park/Getty pictures

However Zelenak believes that argument would solely work “if the IRS was taking the place that antisemitism was an official coverage of [Harvard] in the best way that racial discrimination was an official coverage of Bob Jones … And I simply do not see the comparability there.”

Graetz agrees: “Within the Bob Jones case, it was a coverage of the college to discriminate towards [Black people], whereas Harvard has no coverage to discriminate towards [Jewish people].”

Olatunde Johnson, a legislation professor at Columbia College who has written about Bob Jones, factors out that though racial discrimination was an official, written coverage on the college, it took quite a bit for the college to truly lose its tax-exempt standing.

“This was specific [discrimination],” says Johnson. “And it was nonetheless an extended adjudicatory course of to find out that they had been in truth discriminating.”

If the IRS had been to go after Harvard, Johnson says, “A primary step could be the need of going by means of a course of – whether or not it is an administrative course of, after which a litigation course of – that actually ferrets out the info.”

Congress acted to maintain presidents from utilizing the IRS for political means

This is not the primary time presidents have tried to use the IRS to advance their political agendas. John F. Kennedy directed the company to analyze right-wing teams and Richard Nixon tried to make use of it to focus on and examine his political opponents with audits.

In 1998, Congress took steps to guard the IRS from this type of political strain, and to protect its independence. It was, Graetz says, “an awesome bipartisan effort to get rid of pressures by presidents and different excessive rating officers to audit their adversaries or audit establishments that they discovered to be ideologically uncomfortable.”

The legislation bars the chief department from utilizing the IRS to focus on any explicit taxpayer.

If the IRS had been to behave on Trump’s suggestion to revoke Harvard’s tax standing, Graetz says, “It is essential for the American public to acknowledge that this [would be] a rare intrusion into the position of the IRS.”

Authorized specialists NPR spoke with consider Harvard would have a powerful protection if the Trump administration’s threats turn into materials.

“When the federal government proposes to revoke tax exempt [status], it would not turn into efficient, assuming the group challenges the revocation … except the federal government wins in courtroom,” says Larry Zelenak of Duke. “And I discover that unfathomable.”

Reporting contributed by Adrian Florido

Edited by Nicole Cohen

Visuals by Mhari Shaw

Analysis contributed by Sarah Knight