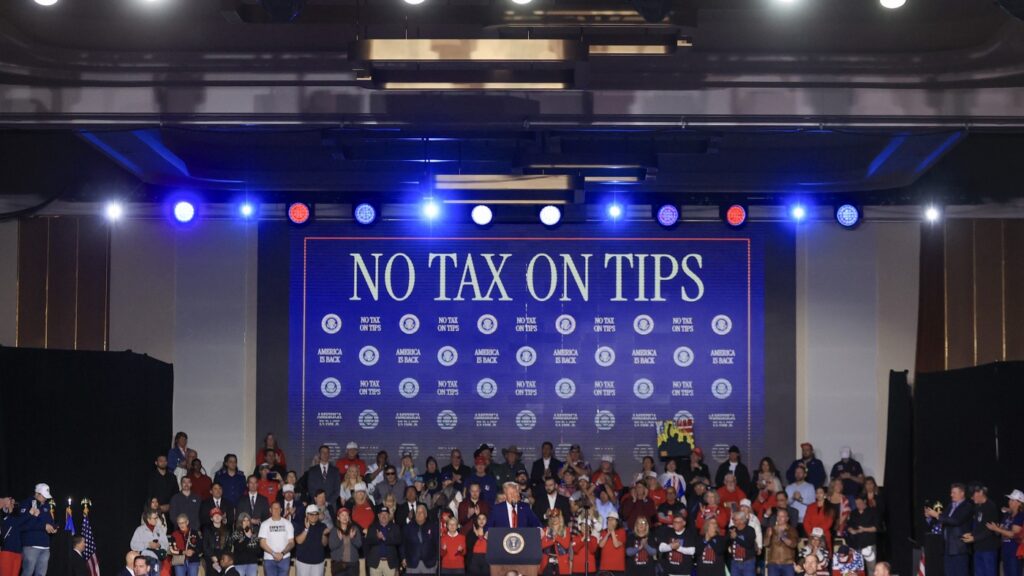

President Trump speaks at a rally at Circa Resort & On line casino on Saturday. The occasion centered on Trump’s first week in workplace, together with his proposed coverage to eradicate taxes on suggestions for service business workers.

Ian Maule/Getty Photographs/Getty Photographs North America

conceal caption

toggle caption

Ian Maule/Getty Photographs/Getty Photographs North America

President Trump at a rally Saturday promised to satisfy his marketing campaign pledge to eliminate taxes on tips.

“Within the coming weeks, I will be working with Congress to get a invoice on my desk that cuts taxes for staff, households, small companies, and really importantly, retains my promise,” mentioned Trump. “We’re gonna get it for you — no tax on suggestions.”

The president, talking at a on line casino in Las Vegas, mentioned tax cuts are on the prime of his legislative agenda for this new Congress.

“In the event you’re a restaurant employee, a server, a valet, a bell hop, a bartender, one among my caddies,” the president mentioned, “your suggestions might be 100% yours.”

Trump’s feedback got here in a 40-minute speech over the weekend that gave the impression of a victory lap greater than a coverage plan. The president rattled off a listing of modifications he is made and proudly spoke about already taking “almost 350 government actions to reverse the horrible failures and betrayals” that he inherited. Trump had issued dozens of executive orders, actions and memoranda since his inauguration final Monday.

Trump first floated the thought of “no taxes on suggestions” on this similar metropolis final June throughout a marketing campaign rally. “After I get to workplace we aren’t going to cost taxes on suggestions, on individuals making suggestions,” Trump mentioned on the time, promising that he would do that “immediately, very first thing in workplace.”

The four-word slogan was plastered on billboards and the Democratic presidential candidate, Kamala Harris, launched a similar version of the idea. It was so widespread amongst a subset of voters that Trump credit it with serving to him win the important thing state of Nevada within the presidential election.

A president cannot unilaterally change the tax code. However massive parts of Trump’s sweeping 2017 tax legislation are set to run out on the finish of 2025 and that might permit Congress a chance to amend current tax coverage.

Earlier this month, the 2 Democratic senators from Nevada joined forces with a bunch of Republicans to reintroduce legislation that might exempt suggestions from federal revenue taxes. “It is one thing that might deliver extra individuals into the restaurant workforce. We’re an business that’s chronically understaffed,” mentioned Sean Kennedy with the Nationwide Restaurant Affiliation, which has endorsed the invoice.

However even when this “no taxes on suggestions” thought has some assist from business and a few bipartisan political assist, tax specialists and economists do not like it.

“I feel it’s truly horrible coverage,” mentioned Heidi Shierholz, president of the Financial Coverage Institute, and a labor economist within the Obama administration. “In the event you actually wish to assist tip staff, do it instantly by elevating the federal minimal wage and phasing out the tipped minimal wage.”

She says she’s involved this coverage would possibly gradual the momentum to overtake the tip employee minimal wage.

The federal minimal wage for tipped staff is $2.13, although sure states have set a better benchmark.

“There isn’t a actual financial advantage to the thought,” mentioned Invoice Gale, co-director of the City-Brookings Tax Coverage and an economist within the George H.W. Bush administration. “It is not a great way to assist low revenue staff as a result of the overwhelming majority of low-income staff do not get suggestions.” That is a degree Alex Muresianu, a senior analyst on the Tax Basis, echoed.

“Why ought to a waiter who earns a giant chunk of their revenue from suggestions get a really massive tax reduce and the cashier who earns, you realize, little to nothing in suggestions, why ought to they not get a tax reduce?” he mentioned.

In accordance with the Budget Lab at Yale University, a overwhelming majority (over 90%) of hourly low-income staff aren’t tipped.

And so Muresianu, Gale, and Shierholz all argue that making a carve-out solely for tip staff might open the system as much as extra abuse, the place high-income earners reclassify their revenue as suggestions. Gale additionally mentioned it will make the tax code “extra sophisticated.”

“And to do that on the similar time, you realize, they’re attempting to chop IRS funding is simply one more instance of why it is a dangerous thought,” he added.

Then there’s additionally the difficulty of misplaced income. The Committee for a Accountable Federal Funds estimates that eliminating suggestions from federal revenue and payroll taxes might cut back revenues by $150 billion to $250 billion over 10 years.

Regardless of the specialists’ misgivings, the thought stays politically widespread.

“I might say economists have by no means labored for $2.13 an hour, so I do not hearken to a variety of what they’re saying,” Ted Pappageorge with Nevada’s culinary union informed NPR in response to the considerations specialists have raised.

Pappageorge, mentioned the union, which represents some 60,000 hospitality staff within the state, welcomes the thought of eliminating taxes on suggestions.

“It must occur,” he mentioned, including in the identical breath, that he additionally desires to see a rise within the minimal wage for tipped staff.

“The fact is each are useful. And we’re difficult President Trump and the Republicans and the Democrats to do each,” saying he appreciates the thought of eliminating taxes on suggestions however he is additionally going to maintain combating for the opposite problem too.

“This concept of $2.13 an hour is simply obscene,” he mentioned. “It truly is.”

And so he’ll take the coverage modifications he can get for now. As a result of, he says, no taxes on suggestions helps decrease the price of dwelling for working households who want fast aid.