Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Whereas homebuyers and residential sellers nonetheless see headlines telling them it’s a vendor’s market and nationwide dwelling costs are reaching all-time highs, a deeper look reveals that a number of regional housing markets have shifted, giving homebuyers some energy.

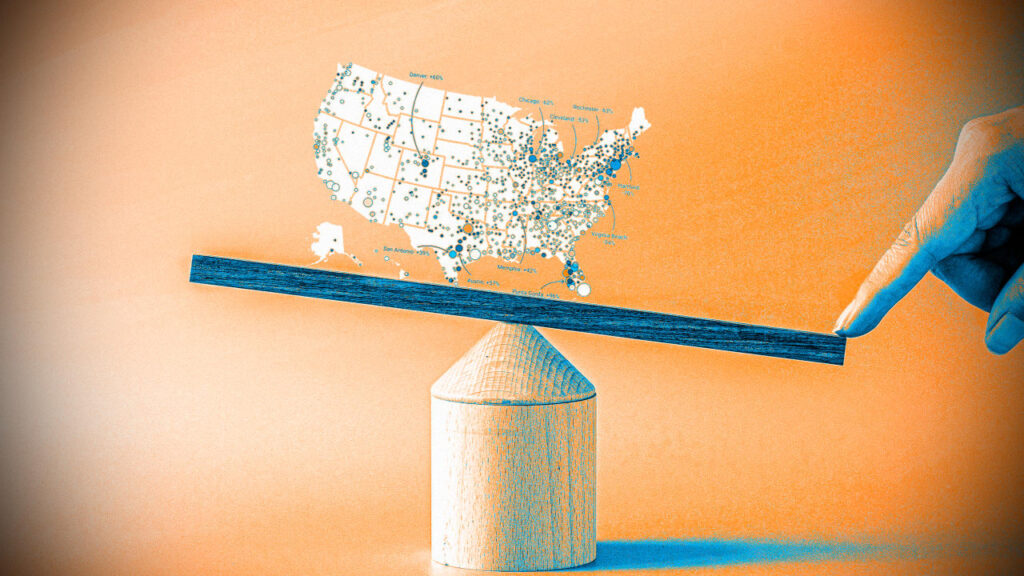

Through the Pandemic Housing Growth, from summer time 2020 to spring 2022, the variety of energetic houses on the market in most housing markets plummeted as homebuyer demand rapidly absorbed nearly every little thing that got here up on the market. Quick-forward to the present housing market, and the locations the place energetic stock has rebounded to 2019 ranges (attributable to strained affordability suppressing purchaser demand) are actually the very locations the place homebuyers maintain probably the most energy.

On the finish of April 2025, nationwide energetic housing stock on the market was still 16% below April 2019 levels. Nevertheless, increasingly regional markets are surpassing that threshold.

This record is rising.

On the finish of January 2025, 41 of those 200 main markets had been again above pre-pandemic 2019 stock ranges.

On the finish of February 2025, 44 of those 200 main markets had been again above pre-pandemic 2019 stock ranges.

On the finish of March 2025, 58 of those 200 main markets had been again above pre-pandemic 2019 stock ranges.

Now, 69 of the 200 markets are above pre-pandemic 2019 stock ranges and ResiClub expects that depend will proceed to rise this yr.

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.fashion.peak=d}}}))}();

Lots of the softest housing markets, the place homebuyers have gained leverage, are situated in Gulf Coast and Mountain West areas. These areas had been among the many nation’s prime pandemic boomtowns, having skilled important dwelling worth development through the pandemic housing growth, which stretched housing fundamentals far past native revenue ranges.

When pandemic-fueled migration slowed and mortgage charges spiked, markets like Cape Coral, Florida, and San Antonio, Texas, confronted challenges as they needed to depend on native incomes to maintain frothy dwelling costs. The housing market softening in these areas was additional accelerated by the abundance of recent dwelling provide within the pipeline throughout the Solar Belt. Builders in these areas are sometimes prepared to cut back costs or make different affordability changes to take care of gross sales. These changes within the new development market additionally create a cooling impact on the resale market, as some patrons who might need opted for an present dwelling shift their focus to new houses the place offers are nonetheless out there.

In distinction, many Northeast and Midwest markets had been much less reliant on pandemic migration and have much less new dwelling development in progress. With decrease publicity to that demand shock, energetic stock in these Midwest and Northeast areas has remained comparatively tight, holding the benefit within the arms of dwelling sellers.

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.fashion.peak=d}}}))}();

Typically talking, housing markets the place stock (i.e., energetic listings) has returned to pre-pandemic ranges have skilled weaker home price growth (or outright declines) over the previous 30 months. Conversely, housing markets the place stock stays far beneath pre-pandemic ranges have, usually talking, experienced stronger home price growth over the previous 30 months.